Crypto Lending Returns In South Korea

Despite tighter oversight from South Korea’s financial regulators, crypto lending services are making a cautious comeback on major domestic exchanges. Platforms such as Upbit, Bithumb, and Coinone are reviving or reshaping their offerings to comply with the government’s updated guidelines, signaling renewed demand for leveraged crypto products.

On Monday, Coinone, the country’s third-largest exchange, introduced its new “coin lending” service. The product allows users to borrow crypto against Korean won collateral, enabling strategies like short selling. Borrowing limits mirror equity market rules, ranging from $22,000 to $51,000 depending on the client profile. At launch, only Bitcoin is supported.

Upbit, the market leader, reintroduced its lending program last week with revised terms, lowering collateral caps from $37,000 to $28,000 in line with the Financial Services Commission (FSC) requirements. Bithumb, the second-largest exchange, continues operating under its existing structure but confirmed adjustments are underway to align with the new framework.

The FSC introduced stricter rules earlier this month to curb excessive leverage and protect investors. Exchanges must now lend only from their reserves, limit offerings to large-cap cryptocurrencies, and enforce annual interest rate caps of 20%. Users must also complete online training and pass suitability assessments before accessing services.

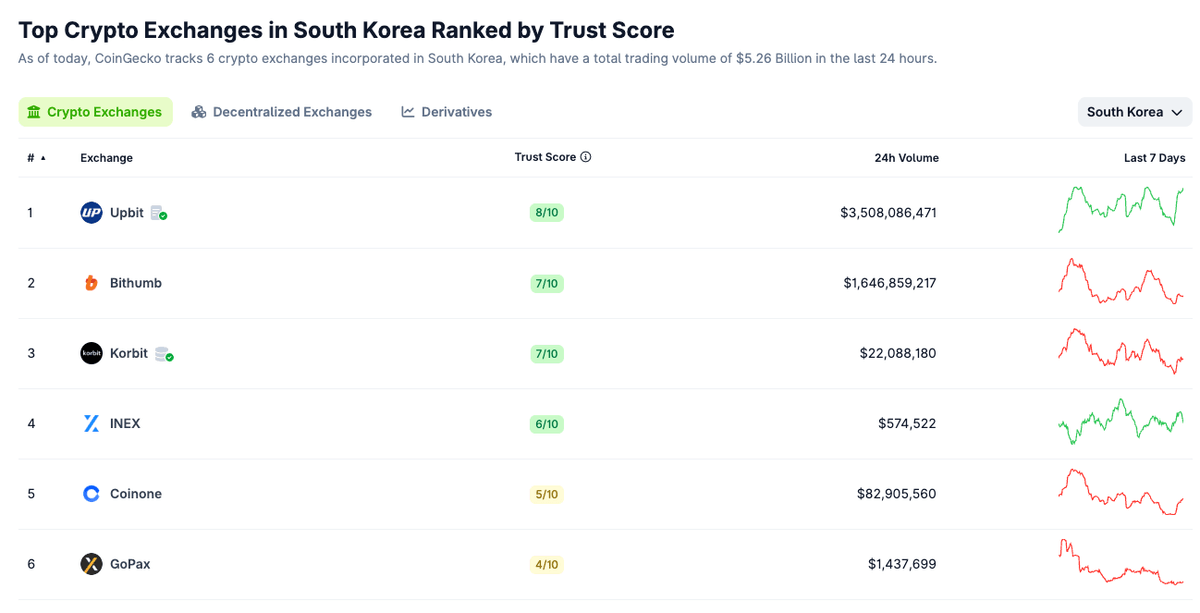

Source: coingecko

Source: coingecko

According to CoinGecko, six Korea-based exchanges—including Upbit, Bithumb, and Coinone—collectively handle $5.26 billion in daily trading volume. The revival of crypto lending under regulatory guardrails highlights the balance between innovation in digital finance and the government’s focus on investor protection.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.