BNB Crypto at All-Time High: Rise or Correction Ahead?

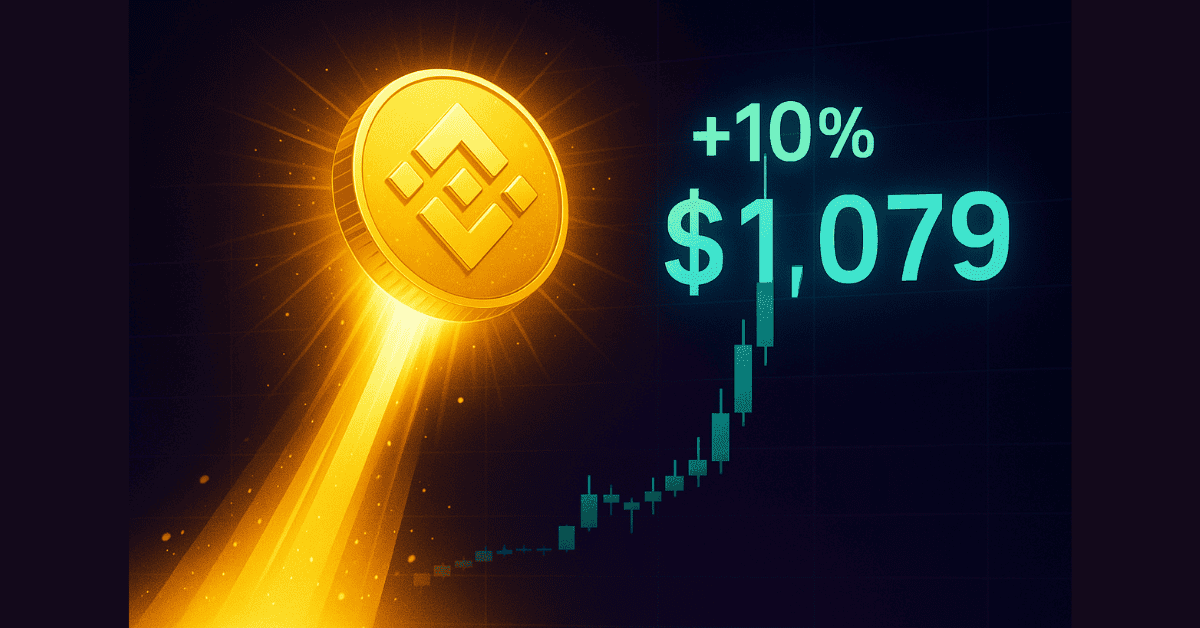

BNB Surges to $1,079 All-Time High

Over the weekend, BNB—the token closely tied to Binance—surged more than 10%, reaching a new record high of $1,079. This marks the highest level in BNB’s history and far surpasses the performance of Bitcoin and Solana, which have only gained around 22% year-to-date. With this breakout, BNB has become the market’s focal point, proving its strong appeal at a time when many other major cryptocurrencies are seeing slower growth.

Institutional Demand Returns

According to analysts, a key reason behind BNB’s rally is the strong comeback of institutional capital. Large funds and publicly traded companies are showing a clear preference for this token. Binance’s efforts to strengthen compliance, resolve legal disputes, and align more closely with international standards have reduced regulatory risks, making BNB a safer choice for institutional investors.

Strategic Partnerships Elevate BNB

Beyond regulatory improvements, BNB is also benefiting from strategic partnerships. Recently, Binance teamed up with Franklin Templeton—a financial giant managing $1.6 trillion in assets. This agreement paves the way for launching new crypto products aimed at a wide range of investors. In addition, CEA Industries, a publicly traded company, announced it will allocate $500 million to purchase BNB instead of Bitcoin or Ethereum. This move signals growing confidence in the BNB Chain ecosystem and the token’s long-term potential.

Binance’s Market Position

Another major factor supporting BNB’s rise is Binance’s dominant role in the crypto trading industry. With 40% of the global spot trading market, Binance remains the industry leader, driving strong demand for BNB as a utility token to offset trading fees. This direct linkage strengthens BNB’s real-world utility, making it increasingly attractive to both retail and institutional investors.

Outlook and Short-Term Risks

While the long-term outlook appears promising, many experts are warning of a potential short-term correction. Sean Dawson, head of research at Derive, believes a pullback is only a matter of time after such a sharp rally. Similarly, Shawn Young of MEXC anticipates that BNB could retrace below $1,000 before resuming its upward trajectory. This suggests that investors should remain cautious, avoid chasing highs, and carefully manage short-term trading strategies.

Conclusion

BNB is demonstrating exceptional strength thanks to a combination of institutional inflows, strategic partnerships, and improved regulatory sentiment. However, its rapid growth also brings the risk of short-term corrections. For investors, BNB represents both an opportunity to capture a token trusted by major institutions and a challenge to manage volatility without being caught off guard by sudden swings.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.