Bitcoin’s Uptrend Continues, But One Red Flag Remains

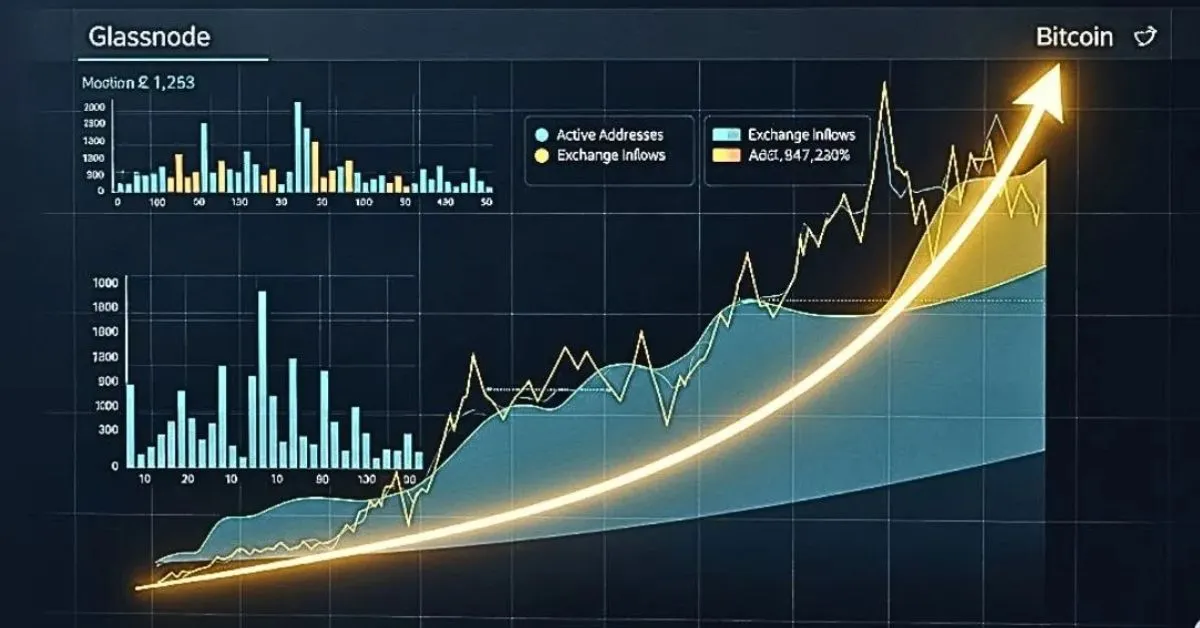

1. Glassnode Confirms: Bitcoin’s Uptrend Still Intact

According to the latest data from on-chain analytics platform Glassnode, Bitcoin’s bullish trend remains intact as long as the price holds above the key support zone between $93,000 and $100,000. This is seen as a major accumulation area where long-term holders are continuing to buy.

2. So Why Are Investors Still Worried?

While the uptrend remains unbroken, several indicators reflect a cooling sentiment. Realized profits are declining, and on-chain volume has dropped below average. This signals a hesitation from new capital inflows - a typical sign of an accumulation phase, which could either precede a breakout or a correction.

3. What Should Investors Do Now?

Experts suggest this is a time to observe and prepare, rather than rush in. If Bitcoin holds above the key support, the next rally may be driven by institutional inflows. But if it breaks below $93,000, a deeper correction could follow.

4. Conclusion: Positive Outlook, But Stay Cautious

The message from Glassnode is clear: the uptrend is still alive, but the market is taking a breather. Investors should closely monitor support zones, keep an eye on on-chain activity, and manage their risk carefully.