Bitcoin Surges As U.S. Fed Lowers Interest Rate

Bitcoin Rises as Fed Cuts Interest Rates by 25 Basis Points

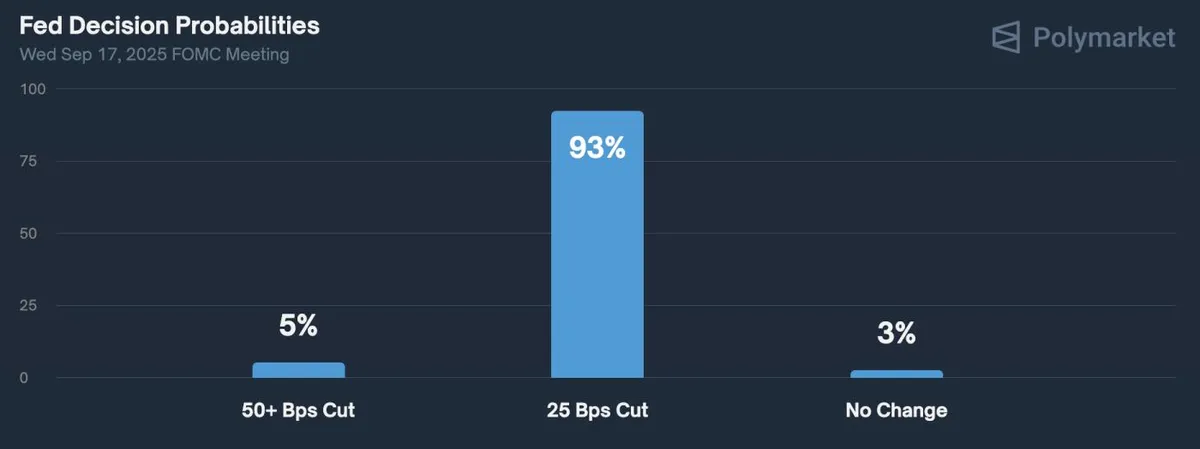

The U.S. Federal Reserve has announced a 25 basis point interest rate cut, marking its first rate reduction in nine months. The decision immediately boosted Bitcoin’s price and brought renewed optimism to the broader crypto market.

Fed Cuts Rates for the First Time in 9 Months

At its latest FOMC meeting, the Fed lowered the federal funds rate target range to 4.00% – 4.25%, following the last cut in December 2024.

The move comes amid slowing economic growth, weaker labor market conditions, and persistently high inflation.

Immediate Impact on Bitcoin

Bitcoin’s price surged right after the announcement. On-chain data from CryptoQuant indicates that major investors continue holding BTC and ETH, with no signs of panic selling.

Julio Moreno, Head of Research at CryptoQuant, stated that the Fed’s rate cut is a positive catalyst for risk assets such as cryptocurrencies.

Meanwhile, capital inflows into stablecoins suggest that investors are preparing to deploy fresh funds into the market. At the same time, some altcoins are seeing outflows, reflecting cautious or strategic positioning.

Lessons From History

During 2020–2021, aggressive rate cuts helped fuel a historic crypto bull run. Lower borrowing costs encouraged investors to chase higher returns in riskier assets.

However, the relationship between Fed rate cuts and crypto rallies is not always linear, leaving room for uncertainty.

Political Pressure Behind the Decision

The timing of this rate cut has sparked debate, given the Trump administration’s increasing pressure on the Fed. Some analysts warn that political influence could erode the Fed’s independence and result in higher inflation, reducing Americans’ purchasing power.

What’s Next for U.S. Consumers and Crypto?

With the labor market weakening and inflation still elevated, the effectiveness of this rate cut will largely depend on upcoming economic data. If successful, it could set the stage for a new wave of growth in Bitcoin and the broader crypto market.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.