Bitcoin Surges As U.S.-China Trade War Escalates

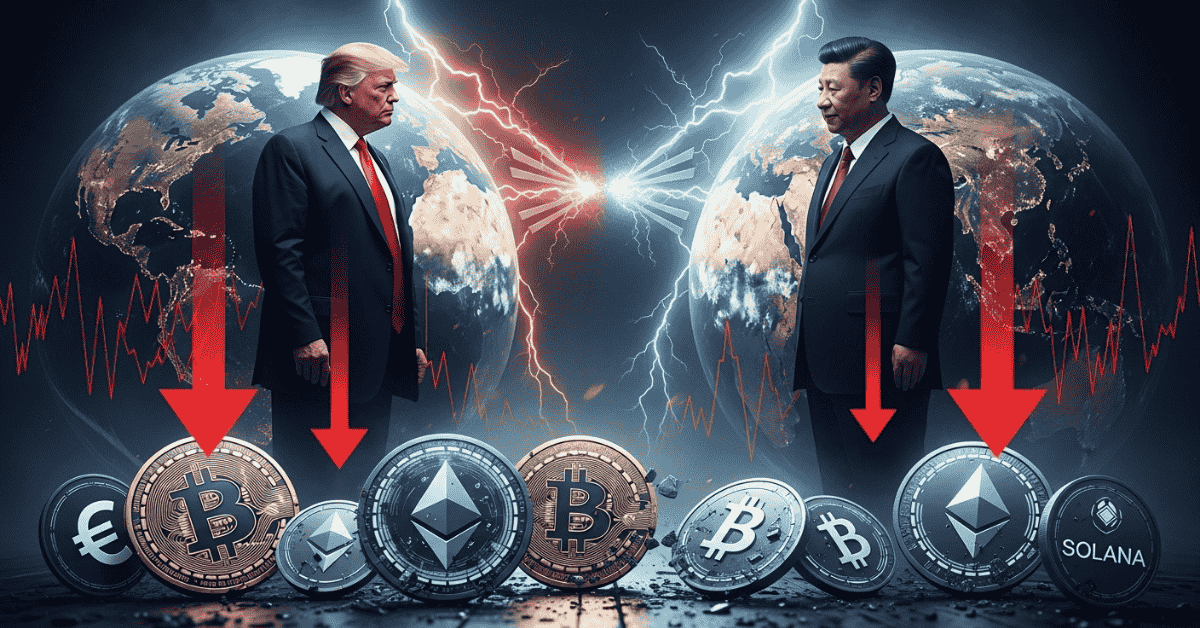

Bitcoin Plunges Amid US-China Trade War Escalation: Billions Liquidated

The global cryptocurrency market experienced an unprecedented sharp decline between October 11-13, 2025, following a shocking announcement by US President Donald Trump regarding massive tariffs on Chinese goods and export controls on software. This event not only triggered widespread panic but also led to billions of dollars in liquidations, severely impacting traders and shaking market confidence.

US-China Trade Tensions Escalate: President Trump's Bold Decision

President Trump's move was not without context. It occurred against a backdrop of already strained trade relations between the two superpowers, which have been escalating for years.

100% Tariffs and Software Export Controls

On October 10, 2025, US President Donald Trump officially declared that an additional 100% tariff would be imposed on all imports from China. This decision, effective November 1, 2025, or sooner, would be stacked on top of existing tariffs, raising the total tariff rate to approximately 130-155%. On the same day, Trump also announced that the US would implement export controls on "any and all critical software" developed by American companies, raising significant concerns about the global technology supply chain.

In Response to China's Actions

This aggressive stance was taken in retaliation to China's move on October 9, 2025, to expand its export controls on critical rare earth minerals. Rare earths are essential materials for high-tech industries such as electric vehicles, defense, and semiconductor manufacturing, with China accounting for roughly 70% of the global supply. President Trump accused China of taking an "extremely aggressive" stance in trade and even hinted at the possibility of canceling a planned meeting with Chinese President Xi Jinping at the upcoming APEC summit in South Korea.

Crypto Market Storm: Billions Evaporate in Record Liquidations

Immediately following President Trump's announcement, the cryptocurrency market reacted almost instantly with a massive sell-off, beginning in late October 10 and intensely continuing through October 11-13, 2025.

Immediate Reaction and Scale of Decline

Even though October is often dubbed "Uptober" with expectations of growth, the market witnessed a completely opposite scenario. Widespread fear caused investors to hastily sell off their assets.

Bitcoin and Altcoins Drowned in Red

Bitcoin (BTC): The world's largest cryptocurrency plummeted from above $125,000 (a recent peak) to approximately $103,000-$106,000. It then traded around $111,616-$115,400 on October 12-13. This marks Bitcoin's lowest level since June 2025.

Altcoins: Many other altcoins were also severely affected. Ethereum (ETH) dropped from about $4,365 to $3,700-$3,780, representing a 13-16% decrease. Solana (SOL) saw a nearly 20% decline, from $223 to $178. Other coins like XRP, BNB, ADA, LINK, AAVE also experienced significant drops ranging from 15% to 40%, pushing many projects into difficult situations.

Record Liquidations and Market Cap Plunge

The most severe consequence of the sell-off was the liquidation of billions of dollars in leveraged positions. This exacerbated the downward trend and caused massive losses for traders.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.