Bitcoin Miner Profits Reach Peak Since the 2024 Halving

July: A "Golden Season" For Bitcoin Miners Post-Halving

According to the latest report from JP Morgan, Bitcoin miners experienced their most profitable month since the April 2024 halving. Average profitability reached $57,400 per EH/s per day, despite the halved block rewards.

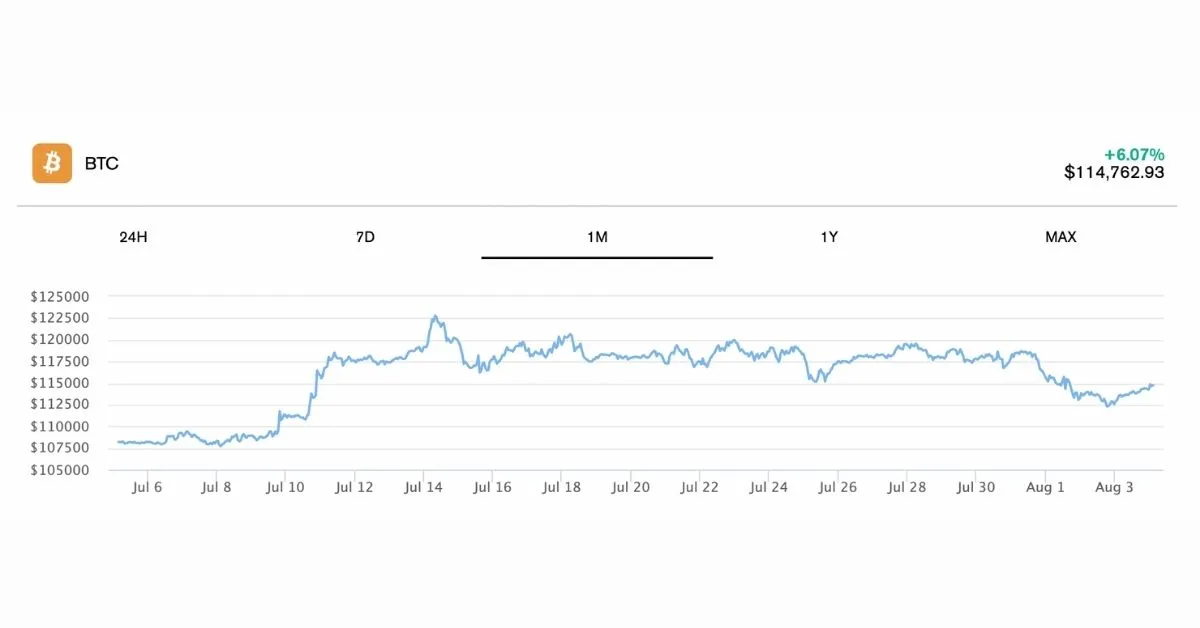

The market witnessed Bitcoin’s price soaring to a record $122,838, driving up revenues for mining operations—especially large-scale companies.

Behind The Numbers: Profit Grows, But Not Without Pain

While July set a new peak in profits, JP Morgan’s report highlights several underlying challenges. Revenue and gross profit per EH/s remain 43% and 50% lower than pre-halving levels. Mining difficulty surged 9% in July alone, pushing up operational costs. The cumulative BTC holdings of the top 11 miners declined in 4 out of the first 6 months of the year, indicating mounting competition and cost pressures.

MARA Holdings – The Giant Still Needs Oxygen

Despite the tough market, MARA Holdings, the world’s largest Bitcoin mining firm, announced. Q2/2025 revenue hit $238 million, up 64% year-over-year. Net income skyrocketed 505%, reaching a record $808 million, mainly due to a $1.2 billion revaluation gain from its Bitcoin holdings.

However, MARA’s stock price dropped 3.6% at week’s end, reflecting investor concerns over ongoing market volatility.

Post-Halving BTC Price Trend: A Rise, But Weaker Than History

Although Bitcoin set a new all-time high, its post-halving growth in 2024 has lagged behind previous cycles. According to analytics firm Kaiko, macroeconomic factors—such as high interest rates and limited capital inflow—have weakened the usual halving-driven price rally.

Conclusion: A Mix Of Opportunity And Challenge

July marked a golden moment for Bitcoin mining, but risks still loom. Rising BTC prices improved short-term profitability. However, higher energy costs, increased difficulty, and reduced rewards cast uncertainty on long-term prospects. Miners must optimize technology and financial strategies to survive and thrive in the post-halving era.