Bitcoin Hits 120k USD Driven by Trump's Crypto Policy

1. Bitcoin's Strong Growth: Political and Legal Factors

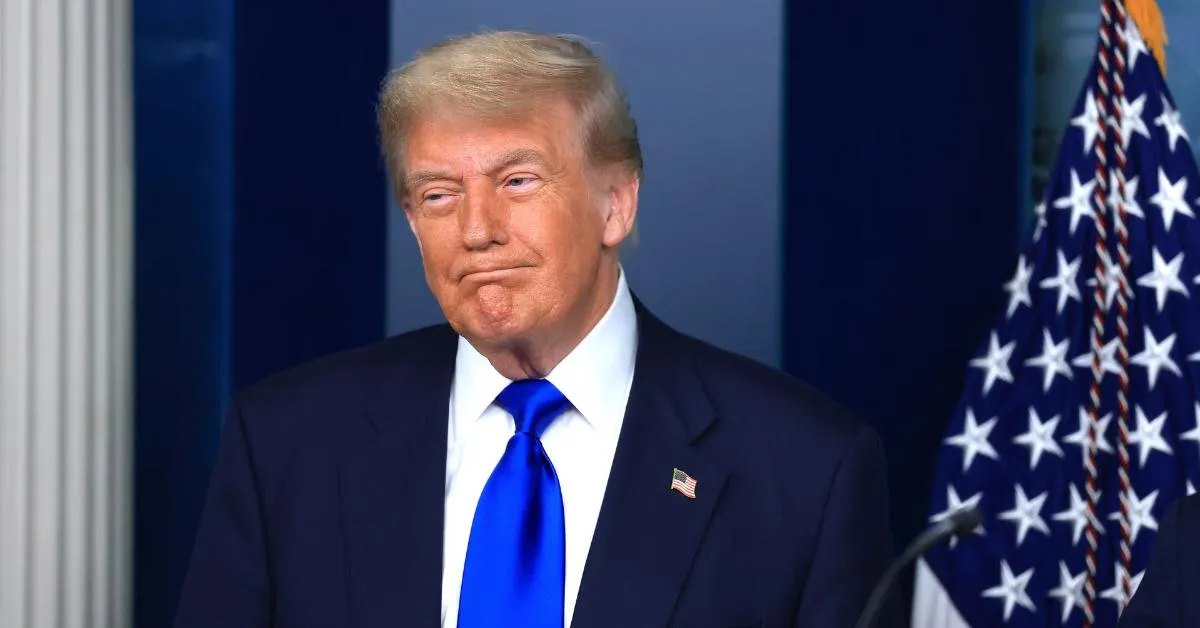

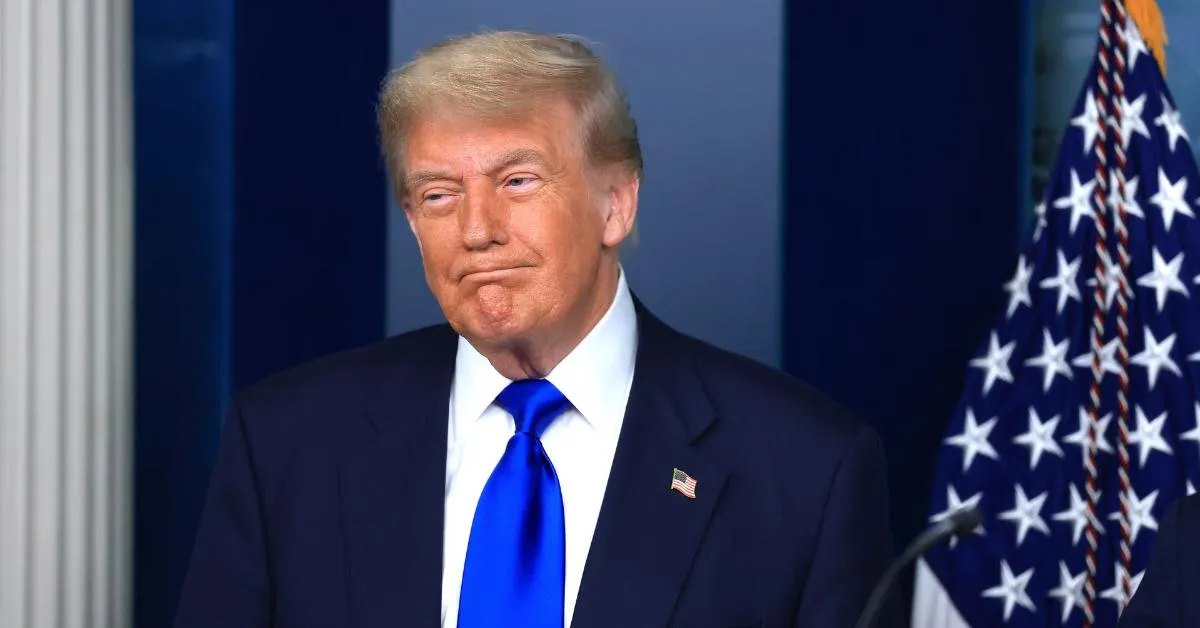

In a surprising move, Bitcoin has reached the milestone of 120,000 USD, surpassing previous record highs. The main reason behind this significant rise is the political and legal changes surrounding crypto, especially from President Donald Trump's administration. During "Crypto Week" in the US, several key crypto-related bills were passed, paving the way for the industry’s development. Notably, the CLARITY Act and the GENIUS Bill are expected to have a major impact on the crypto market moving forward.

This also reflects the changing perspective of authorities towards crypto. The Trump administration is preparing to sign an executive order allowing crypto investments to be included in retirement accounts, specifically 401(k) plans, which were previously restricted. This move will expand investment opportunities for American retirement savers, giving them access to new asset classes like gold, private equity, and infrastructure funds, offering greater flexibility in asset management.

2. Trump’s New Crypto Policy and Its Impact on the Market

One significant aspect of the new policy is the reversal of previous guidance, which discouraged including crypto in retirement plans. The Trump administration has announced that fund managers can now decide whether to include crypto in their investment plans without federal disapproval. This is a critical shift, as the inclusion of crypto in retirement plans was previously a contentious issue. This decision not only opens up opportunities for individual investors but also provides a strong incentive for large financial institutions to engage more deeply in the cryptocurrency space.

These regulatory changes have already been reflected in the market, with Bitcoin and other crypto assets seeing a surge in value. The shift in policies not only boosts investor confidence in crypto but also broadens the potential for integrating cryptocurrencies into traditional financial systems. This strategic move by the Trump administration aims to create a favorable environment for the sustainable growth of crypto and other digital assets.

3. The Future of Crypto in Retirement Plans and Its Economic Impact

The inclusion of crypto in retirement investment plans could open a new future for American investors. This shift will not only affect individual investment decisions but also have a broader impact on the global economy. If this trend continues, many investors will have the opportunity to diversify their portfolios, reducing dependence on traditional assets like stocks and bonds. This could increase the liquidity of the crypto market and help stabilize digital currencies.

With the participation of retirement funds in the crypto market, Bitcoin and other cryptocurrencies may continue to rise in value in the future. However, financial experts warn that while crypto holds great potential, it is also a highly volatile market and could face unforeseen risks. Therefore, investors should proceed with caution and conduct thorough research before incorporating crypto into their investment portfolios.