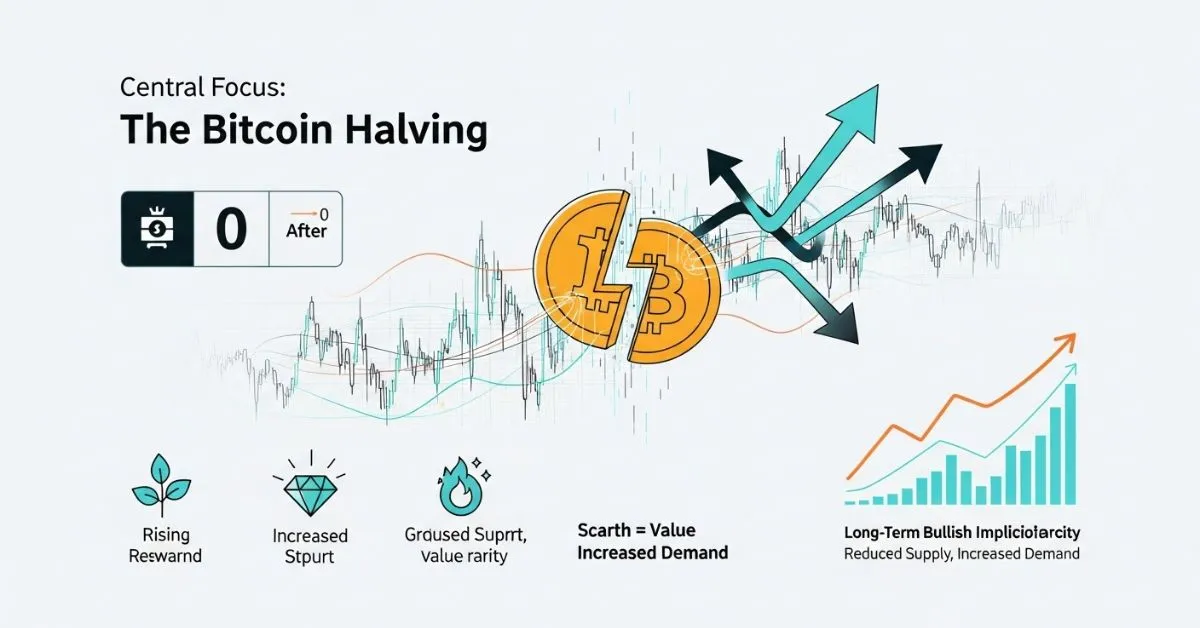

Bitcoin Halving Countdown: Volatility & Bullish Outlook

The cryptocurrency world holds its breath as the highly anticipated Bitcoin Halving event draws to a close, with less than 24 hours remaining until this pivotal moment. This quadrennial event, fundamental to Bitcoin's economic model, is already sending ripples across the market, evidenced by a noticeable surge in price volatility. As the countdown intensifies, market analysts and investors are scrutinizing every price movement, attempting to predict the immediate aftermath while largely agreeing on the profound, long-term bullish implications for the digital asset.

Understanding The Bitcoin Halving Mechanism

The Bitcoin Halving is a pre-programmed event embedded in Bitcoin's protocol that occurs approximately every four years, or every 210,000 blocks. Its primary function is to reduce the reward miners receive for validating transactions and adding new blocks to the blockchain by half. This crucial mechanism is designed to control the supply of new bitcoins entering circulation, mimicking the scarcity of precious metals like gold.

Historical Context Of Previous Halvings

Bitcoin has undergone three previous halvings, each followed by significant price appreciation in the subsequent months and years. These historical precedents form a cornerstone of the bullish argument:

• First Halving (2012): Block reward reduced from 50 BTC to 25 BTC.

• Second Halving (2016): Block reward reduced from 25 BTC to 12.5 BTC.

• Third Halving (2020): Block reward reduced from 12.5 BTC to 6.25 BTC.

Each event has historically reinforced Bitcoin's store-of-value proposition and its inherent digital scarcity.

Current Market Dynamics: Volatility On The Eve Of Halving

As the fourth Halving approaches, the cryptocurrency market is exhibiting heightened volatility. This is a characteristic trait of such high-stakes events, where speculative trading, profit-taking, and investor uncertainty converge. Analysts are observing rapid price swings, indicating a battle between those anticipating a pre-halving dip and those front-running a potential post-halving surge.

Experts remain divided on the immediate price impact following the Halving. Some believe that the event is largely 'priced in' by the market, meaning its effects have already been partially absorbed into current valuations. Others contend that the psychological impact and the actual supply shock could still trigger significant short-term movements, either upwards or downwards, as market participants react to the new reality of reduced issuance.

The Long-Term Bullish Implications: Scarcity And Demand

Despite the short-term uncertainty, there's a near-unanimous consensus among market participants and experts regarding the long-term bullish implications of the Bitcoin Halving. The core argument rests on fundamental economic principles: reduced supply against potentially sustained or increasing demand will inevitably lead to higher prices.

With the block reward set to decrease once again, the rate at which new bitcoins are created will effectively be cut in half. This directly enhances Bitcoin's digital scarcity, making it a more attractive asset for investors seeking a hedge against inflation or a long-term store of value. The Halving reinforces Bitcoin's fixed supply cap of 21 million coins, solidifying its position as a deflationary asset in an increasingly inflationary global economy.

Bitcoin As Digital Gold

The Halving narrative strengthens Bitcoin's appeal as 'digital gold.' Like gold, its supply is limited and predictable, contrasting sharply with fiat currencies that can be printed infinitely. This intrinsic scarcity, cemented by the Halving mechanism, is a key driver for its adoption as a hedge and a long-term investment.

Navigating The Post-Halving Landscape

For investors, the period immediately following the Halving often involves careful observation. While historical patterns suggest a bullish trajectory in the months and years post-halving, market conditions are always dynamic. Diversification, thorough research, and a long-term investment perspective (HODL strategy) are generally recommended strategies.

For Bitcoin miners, the Halving means their revenue per block is cut. This often leads to increased competition, a push for greater energy efficiency, and potentially a consolidation among mining operations, as less efficient miners may be forced out. However, if the BTC price appreciates significantly in the long run, it can offset the reduced block reward, making mining profitable again.

Conclusion: A New Chapter For Bitcoin

The approaching Bitcoin Halving is more than just a technical event; it's a critical juncture in Bitcoin's journey, reaffirming its foundational principles of scarcity and decentralization. While the immediate market reaction might involve continued volatility and divided opinions on short-term price action, the overarching sentiment points towards a significantly bullish long-term outlook. By dramatically reducing the new supply of BTC, the Halving sets the stage for a potential increase in value, reinforcing Bitcoin's role as a unique and resilient digital asset in the global financial landscape. As the clock ticks down, the crypto community stands ready to witness another defining moment for the world's leading cryptocurrency.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.