BTC Nears $123K, ETH Breaks $4,300 On Policy Shift

After a lackluster week, cryptocurrencies surged on Monday, with Bitcoin nearing its record high just above $123,000 and Ethereum topping $4,300 for the first time in years.

Geopolitical developments and policy news boosted risk appetite at the week’s open. Last week, despite Trump’s tariffs and downbeat economic data, Wall Street equities held firm, and crypto remained cautious. On Monday, US stock futures pointed to another strong start, with indexes close to record highs.

Domestically, remarks from Fed Governor Michelle Bowman advocating rate cuts, along with President Donald Trump’s executive order instructing agencies to revisit rules for including assets such as cryptocurrencies and private equity in 401(k) retirement plans, lifted prices across the market.

According to CoinGecko, total cryptocurrency market capitalization hit a record $4.14 trillion on Monday, driven by gains in BTC and ETH.

Bitcoin Momentum Builds Toward New High

Bitcoin jumped 3.3% to over $122,000, closing in on its all-time peak. Over the last week, BTC rose 6.6% after retreating from mid-July highs.

Momentum late last week was fueled by Washington’s crypto-friendly executive order and three days of net inflows into spot Bitcoin ETFs. Data from Farside Investors shows ETF issuers bought $773 million worth of BTC in just three sessions.

Figures from BitcoinTreasuries.net indicate corporate bitcoin treasuries now hold a combined $117 billion in BTC.

Trump’s order could eventually free up $9 trillion from 401(k) funds for crypto markets — a long-term catalyst pending regulatory action.

On Sunday, Michael Saylor posted on X, hinting at further BTC accumulation within his firm’s $76.8 billion portfolio:

“If you don’t stop buying Bitcoin, you won’t stop making money.”

Ethereum Pushes Past $4,300

Institutional demand also fueled Ethereum’s rally, with an anonymous buyer acquiring over 270,000 ETH in the past five days.

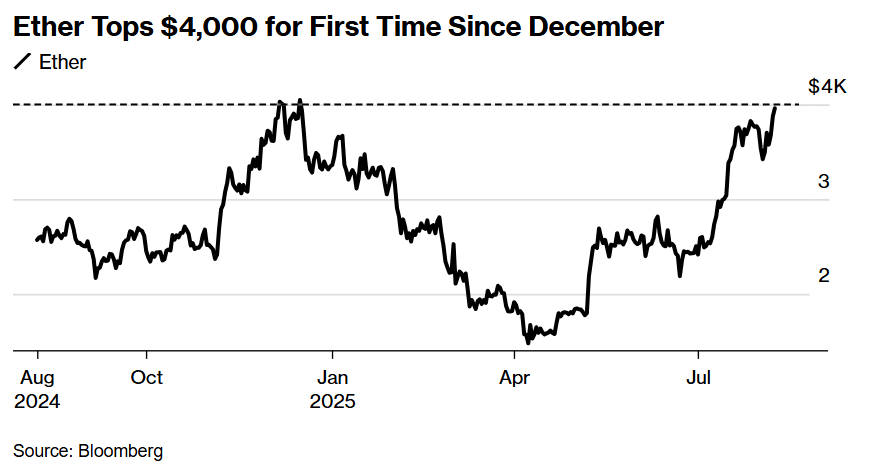

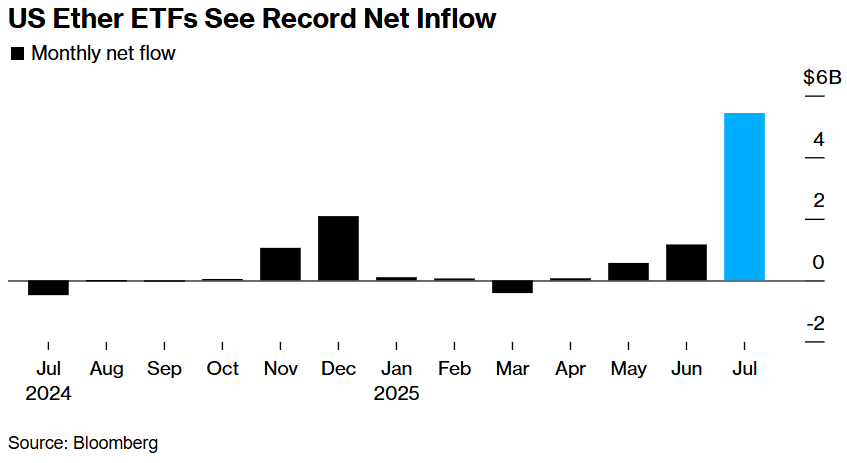

ETH climbed above $4,300 for the first time since December 2021, after hitting $4,013 on Friday in New York before easing to $3,965. The token is up 22% this week and has surged about 190% since April lows, largely thanks to record inflows into spot Ether ETFs.

So far this year, US-listed Ether ETFs have attracted over $6.7 billion. Data from strategicethreserve.xyz shows corporate ETH treasuries have accumulated more than $12 billion worth of the asset. Large purchases by Bitmine, Sharplink, and The Ether Machine contributed to the weekend boost.

While ETH remains 18% below its all-time high of $4,867 from November 2021, investor sentiment has turned sharply positive.

Trump’s son, Eric — an investor in several crypto ventures — celebrated ETH’s surge on X. Meanwhile, Bloomberg reports the Trump family’s World Liberty Financial is in talks to set up a public company for its WLFI tokens.

Ethereum co-founder Vitalik Buterin, however, cautioned against an “overleveraged game” among ETH treasury companies.

Despite this warning, with Ethereum’s strong fundamentals and active developer base, analysts believe a new record high is within reach if macro conditions remain favorable.