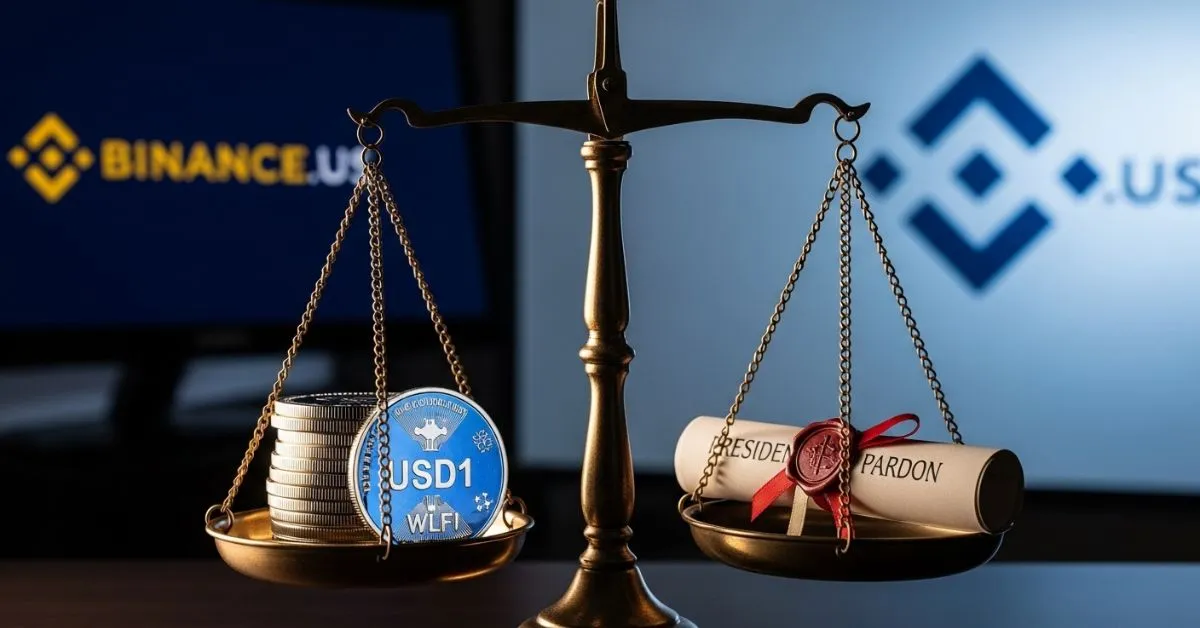

Binance.US Lists Trump-Linked USD1: Political Quid Pro Quo?

The cryptocurrency market has recently been shaken by a wave of controversy surrounding Binance.US's decision to list USD1 and WLFI tokens. These tokens are associated with World Liberty Financial, a crypto venture backed by former President Donald Trump. What makes this particularly contentious is that the listing occurred just days after Trump pardoned Changpeng Zhao (CZ), the founder of Binance. This striking coincidence has triggered sharp accusations of a "political quid pro quo" from lawmakers and analysts alike.

The Pardon And Its Political Backdrop

At the heart of the controversy is former President Donald Trump's pardon of Changpeng Zhao (CZ) on October 23, 2025. CZ had previously pleaded guilty to failing to maintain an adequate anti-money laundering system at Binance, which resulted in Binance paying a $4.3 billion penalty and CZ himself serving four months in prison and paying a $50 million fine. This pardon, while seen by some as a positive signal for the crypto industry, met with strong opposition from Democratic lawmakers.

The Contested Token Listings: USD1 And WLFI

On October 28, 2025, Binance.US opened deposits for USD1/USDT and WLFI/USDT pairs, with trading commencing the following day. USD1 is a U.S. dollar-pegged stablecoin issued by World Liberty Financial, a crypto project linked to the Trump family. WLFI is the governance token for the same project. USD1 is currently the sixth-largest stablecoin globally, boasting a market capitalization of approximately $2.97 billion. The Trump family reportedly holds a significant financial stake in World Liberty Financial, including $5.7 billion in WLFI tokens and a $3.4 billion USD1-linked fortune.

Accusations Of Political Quid Pro Quo

The timing of Binance.US's listings, immediately following the pardon, raised significant eyebrows. Numerous Democratic lawmakers, including Senator Chris Murphy, Elizabeth Warren, Adam Schiff, and Representative Ro Khanna, accused the exchange of engaging in a "political quid pro quo" or "pardon payback" for Trump's decision to pardon CZ. They framed the listing as a reward for Trump's commutation of CZ's prison sentence. Representative Maxine Waters accused Trump of favoring "crypto criminals" who enriched his family's ventures, while economist Robert Reich labeled it a "Pay-to-Pardon Scheme." Lawmakers also cited a $2 billion investment funneled through World Liberty Financial's USD1 stablecoin, connecting Binance with Trump's ventures. Following the pardon announcement, the WLFI token's value briefly surged over 20.72%.

Binance.US's Defense

Binance.US has vehemently denied all allegations of political bias or a quid pro quo. The exchange maintained that the listing was a "standard business decision" and "purely business decisions." Binance.US emphasized that USD1 and WLFI had already passed their internal listing committee review and were approved through their "ordinary course of business" and "standard procedures" well before any recent political events.

To further support its claims, Binance.US highlighted that both USD1 and WLFI are already listed on over 20 other major U.S. exchanges, including Coinbase, Kraken, and Robinhood, indicating widespread market acceptance. The exchange also expressed regret that "even routine business decisions are now being unfairly politicized by elected officials."

Broader Implications And Market Impact

This incident is not merely an isolated controversy; it underscores the increasing intersection of politics and the cryptocurrency market, particularly in the context of Trump's pro-crypto agenda. It raises questions about the transparency and independence of exchange listing decisions and the potential for conflicts of interest. The event has also impacted market sentiment, with WLFI token prices seeing a significant jump after the pardon announcement. Furthermore, the launch of USD1 on the Binance Smart Chain (BSC) allegedly activated the BSC ecosystem's "speculative engine," with B coin's market value soaring and PancakeSwap's Total Value Locked (TVL) increasing by 47%.

Conclusion

The controversy surrounding Binance.US's listing of USD1 and WLFI reflects the ongoing tension between cryptocurrency market operations and political scrutiny. While Binance.US adamantly defends its decision as purely business-driven, the accusations of a "political quid pro quo" from lawmakers raise critical questions about integrity and transparency in the crypto industry, especially as prominent political figures engage with the space. As election seasons loom, the nexus between crypto initiatives and political actions is likely to remain a subject of intense examination.

The content above reflects the author's personal views only and does not represent any official stance of Cobic News. The information provided is for reference purposes only and should not be considered investment advice from Cobic News.