3 Reasons The Solana Rally May End Soon

Solana Price Surges but Risks Loom

Over the past 7 days, Solana (SOL) has gained 5.3%, currently trading near $220. In just three days, SOL jumped from $200 to $220 (+10%), marking an impressive rally. However, experienced traders note that every time Solana breaks strongly above $200, the rallies often don’t last long.

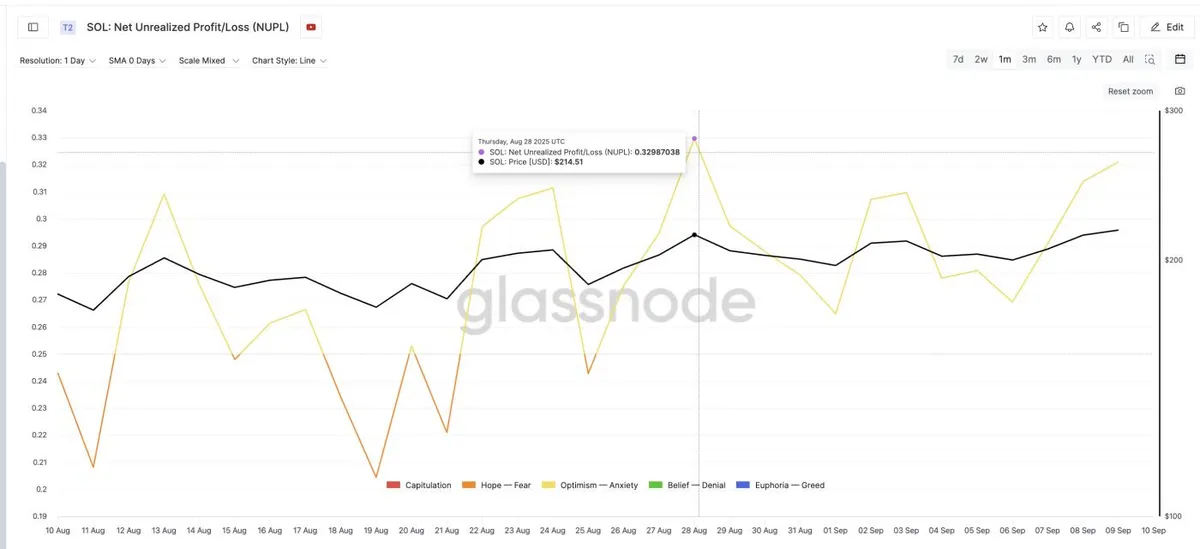

Solana Traders Sitting On Unrealized Profit: Glassnode

Profit-Taking Pressure Is Growing

The NUPL (Net Unrealized Profit/Loss) indicator for Solana reached 0.321 on September 9, 2023 – the second highest in the past month. Previously, when NUPL hit 0.329 in late August, SOL corrected by nearly 8%. High NUPL values suggest investors are sitting on strong paper gains, which increases the risk of profit-taking.

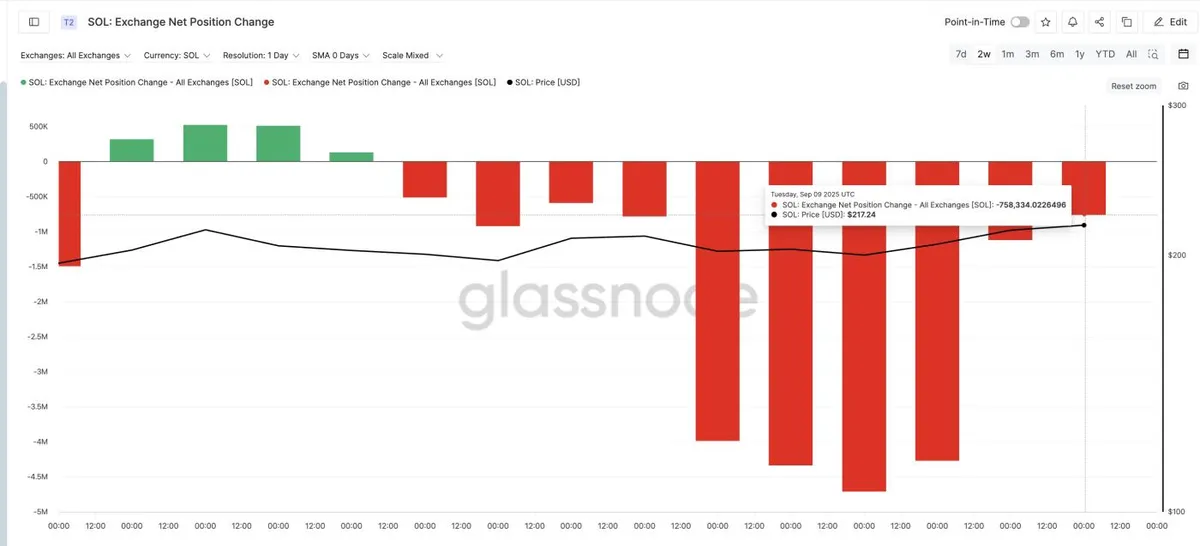

Exchange Flows Signal Weak Demand

Glassnode data shows that on September 6, net outflows of Solana reached -4.7 million SOL, but by September 9, the figure dropped sharply to -758,000 SOL. Even though price rose nearly 10%, buying pressure weakened by 84%. This mismatch indicates buyers are slowing down while sellers may be quietly stepping in.

Solana Sellers Reappearing: Glassnode

Bearish Divergence Appears on Charts

Between August 14 and September 10, Solana’s price kept printing higher highs, but the RSI (Relative Strength Index) posted lower highs – a classic bearish divergence. This suggests momentum is fading, with selling pressure building behind the scenes.

- A daily close below $207 could open the way to $197 and then $189.

- Conversely, a daily close above $222 would invalidate the correction thesis and give bulls back control.

Solana Price Analysis: TradingView

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.