3 Made-In-USA Coins Stand Out After Crypto Crash

Last weekend’s “Black Friday” crash wiped out over 20 billion USD in leveraged positions, triggered by renewed U.S.–China tariff tensions. Yet amid the market chaos, several U.S.-based cryptocurrencies have shown surprising resilience — even hinting at renewed investor demand.

Here are three Made-in-USA coins worth watching as the market attempts to recover in mid-October.

Horizen (ZEN): Privacy Coin Shows Strength Amid Volatility

Horizen’s native token, ZEN, is standing out thanks to its zero-knowledge proof (ZK) infrastructure focused on privacy.

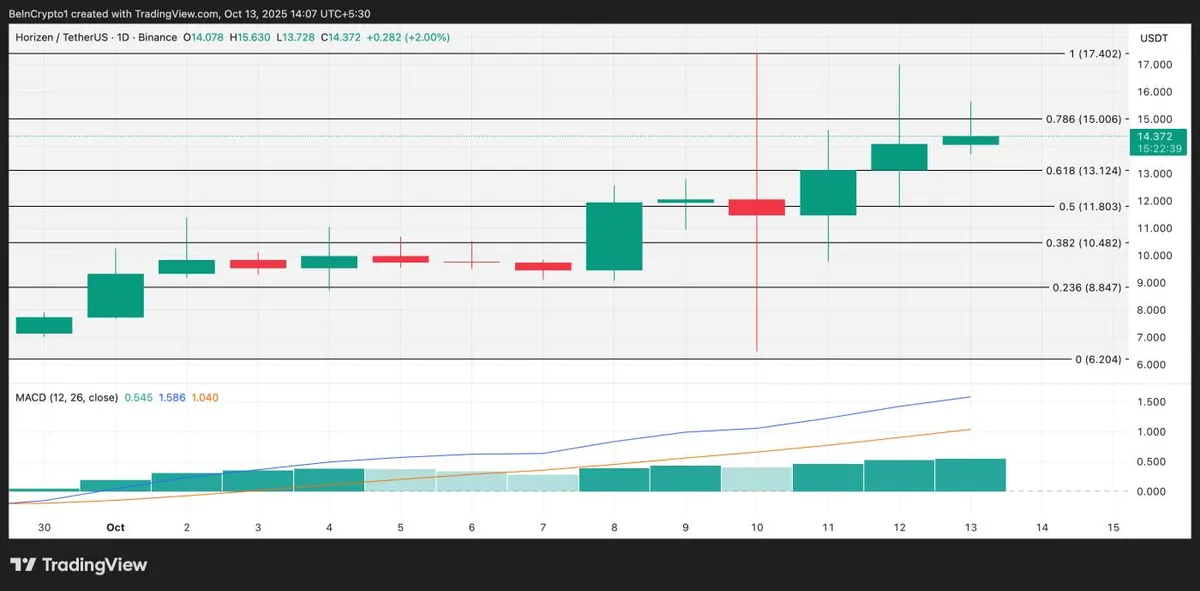

At the time of writing, ZEN trades at 14.37 USD, marking a 15% rebound since Friday’s market crash.

According to the MACD indicator on the daily chart, bullish momentum is building, with the MACD line crossing above the signal line — a classic bullish crossover pattern. This signals growing buying pressure and a potential upward continuation if trading volume supports it.

If the momentum holds, ZEN could climb above 15.00 USD, while increased profit-taking may push it down to 13.12 USD.

ZEN Price Analysis. Source : TradingView

Basic Attention Token (BAT): Brave Browser’s Utility Token Rebounds Strongly

Another strong performer from the U.S. is Basic Attention Token (BAT), the native token of Brave Browser. Despite a sharp 23% drop on Friday, BAT has since recovered over 60%, currently trading near an eight-month high of 0.2102 USD.

Technical analysis shows BAT trading above its 20-day Exponential Moving Average (EMA) at 0.1572 USD, now acting as dynamic support. This indicates renewed bullish momentum, suggesting the potential for further gains.

If the trend continues, BAT could reach 0.2324 USD in the coming sessions.

BAT Price Analysis. Source: TradingView

SUPRA: Capital Inflows Signal Growing DeFi Confidence

SUPRA, the native token powering Supra’s automated DeFi blockchain, has also drawn attention. After dipping 10% on Friday, the token’s price has steadily risen since, fueled by strong on-chain accumulation.

The Chaikin Money Flow (CMF) indicator for SUPRA has moved above the zero line, showing positive capital inflows and increasing buying pressure.

If this momentum persists, SUPRA could rise to 0.002786 USD, though potential market pullbacks might drag it back to 0.002130 USD.

SUPRA Price Analysis. Source: TradingView

Bottom Line

Despite a turbulent weekend for crypto markets, U.S.-origin projects like ZEN, BAT, and SUPRA are proving their resilience, signaling possible early accumulation as traders position for the next rebound.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.