3 Altcoins Face Billions In Liquidation Risk

3 Altcoins at High Liquidation Risk in the Final Week of September

The altcoin derivatives market is experiencing heavy turbulence in the last week of September, with more than $200 billion in market capitalization wiped out in just a short period. This sharp downturn has created a clear imbalance between the total accumulated Long and Short positions, fueling bearish sentiment across the market. In this context, three altcoins — Ethereum (ETH), Solana (SOL), and Avantis (AVNT) — stand out as the most exposed to massive liquidation risks.

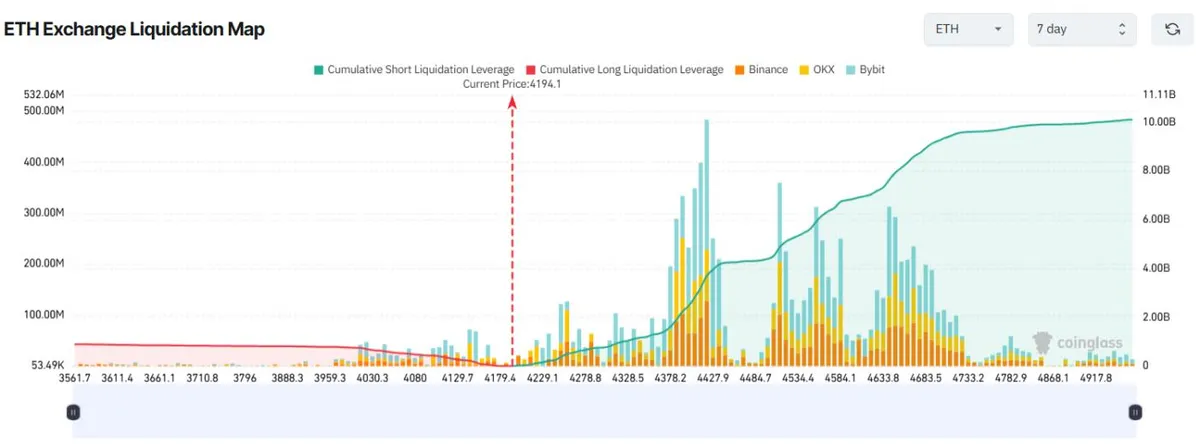

Ethereum (ETH) – Billions at Stake

Ethereum currently faces the largest potential liquidation volume among all altcoins. The seven-day liquidation heatmap reveals that traders are allocating significant capital and leverage to Short positions, pushing ETH’s potential liquidation scale into the billions. If ETH manages to rebound to $4,500, the accumulated Short liquidations could exceed $4.5 billion, while a move above $4,900 may push the figure close to $10 billion. On the downside, if ETH drops further toward $3,560, Long liquidations could reach nearly $900 million. Although whales are starting to take profits as the number of profitable ETH addresses hits an all-time high, on-chain data suggests that accumulation is far from slowing down. A renewed wave of institutional buying could trigger a strong recovery, forcing large-scale Short liquidations.

Source: Coinglass

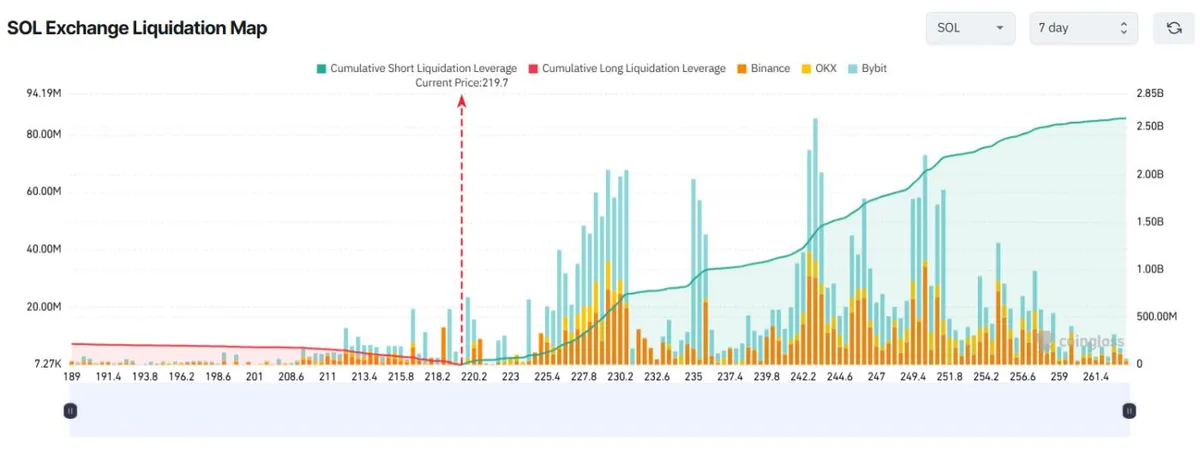

Solana (SOL) – Short Liquidations Far Outweigh Longs

Solana also enters the spotlight this week with high liquidation risks. In just 24 hours, SOL’s price plunged over 7%, intensifying bearish sentiment among derivatives traders. The liquidation map shows that if SOL rebounds to $250, more than $2.5 billion worth of Shorts could be wiped out. Conversely, if SOL falls below $190, around $215 million in Long positions may be liquidated. A key development supporting Solana is the U.S. SEC’s recent approval of the Grayscale Digital Large Cap (GDLC) Fund, the first multi-asset crypto ETP that includes BTC, ETH, XRP, SOL, and ADA, along with new ETF listing standards. These positive catalysts could fuel a strong rebound for Solana, placing massive pressure on Shorts if selling momentum eases.

Source: Coinglass

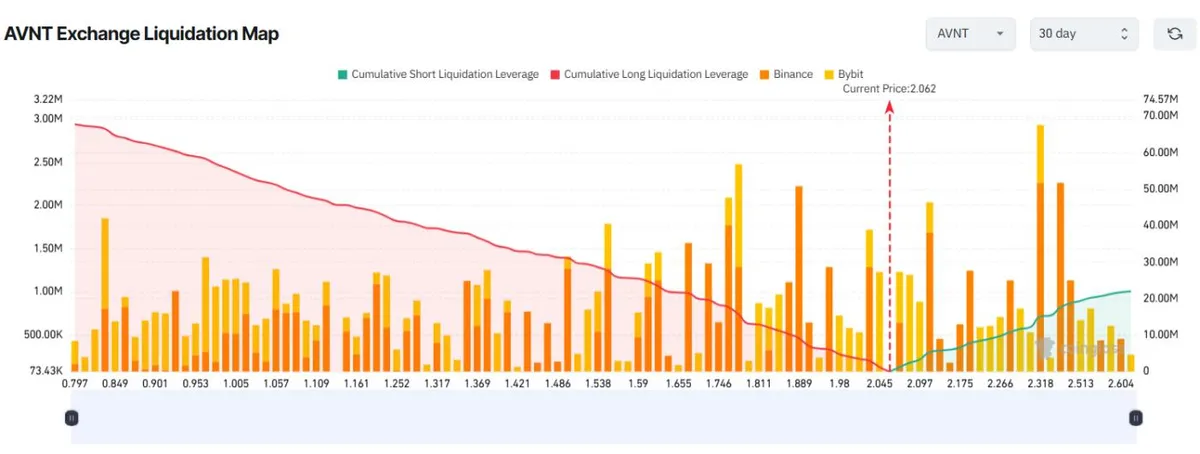

Avantis (AVNT) – Explosive Growth Comes With High Risk

Although Avantis does not carry the billion-dollar liquidation scale of Ethereum or Solana, its rapid rise makes it highly notable. In September alone, AVNT surged more than 600%, driven by simultaneous listings on three major exchanges: Upbit, Bithumb, and Binance. This meteoric growth has drawn a flood of speculative activity in derivatives markets, where Long positions dominate. According to liquidation data, if AVNT corrects to $1, nearly $60 million in Longs could be liquidated. On the other hand, if it rallies to $2.6, more than $21 million in Shorts may be at risk. Early investors are sitting on enormous profits, and on-chain data confirms that one whale locked in gains of over 700% today. Should profit-taking accelerate across the board, AVNT’s overleveraged Longs could face significant downside risk.

Source: Coinglass

Conclusion

Coinglass reports that in just the past 24 hours, more than 387,148 traders have been liquidated, with the total value exceeding $1.67 billion. This figure could remain elevated as September closes out with heightened volatility. Ethereum, Solana, and Avantis are at the center of this risk cycle, and traders would be wise to closely monitor liquidation maps and price action before making their next moves.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.