3 Altcoins at High Liquidation Risk This Week

The fourth week of July marks a historic milestone as the total cryptocurrency market capitalization surpasses $4 trillion. Altcoin capitalization is also nearing its all-time high, reflecting renewed investor confidence. However, with leveraged trading activity soaring, several popular altcoins may be facing major liquidation risks this week.

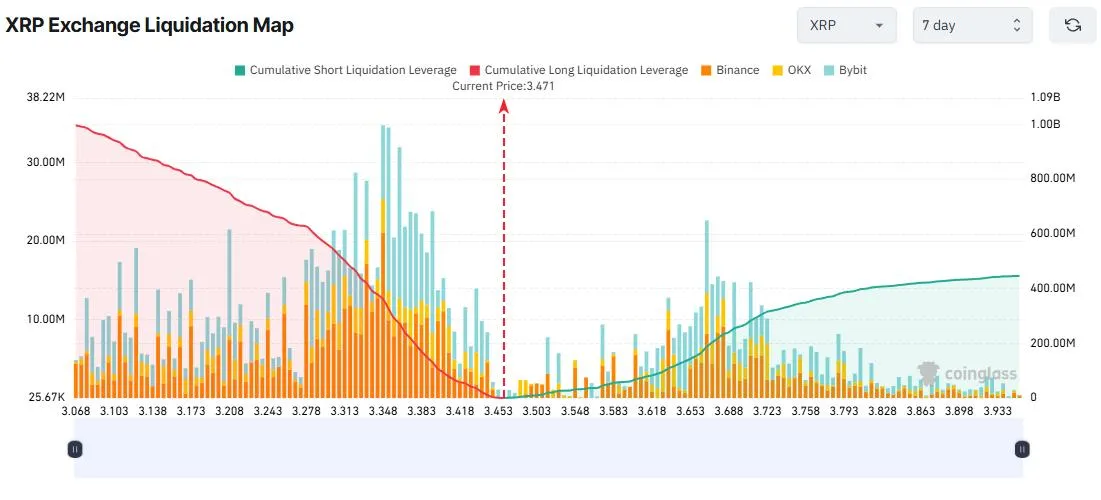

1. XRP – Nearly $1 Billion In Long Liquidation Risk

According to Coinglass, XRP’s Open Interest (OI) has reached a record high of $10.9 billion in July. Notably, the Funding Rate has turned positive and hit its highest level since the beginning of the year, signaling strong bullish sentiment as many traders bet on price increases.

This optimism has led to an imbalance in the liquidity map, with far more Long than Short positions. If XRP drops to $3 this week, total long liquidation value could approach $1 billion.

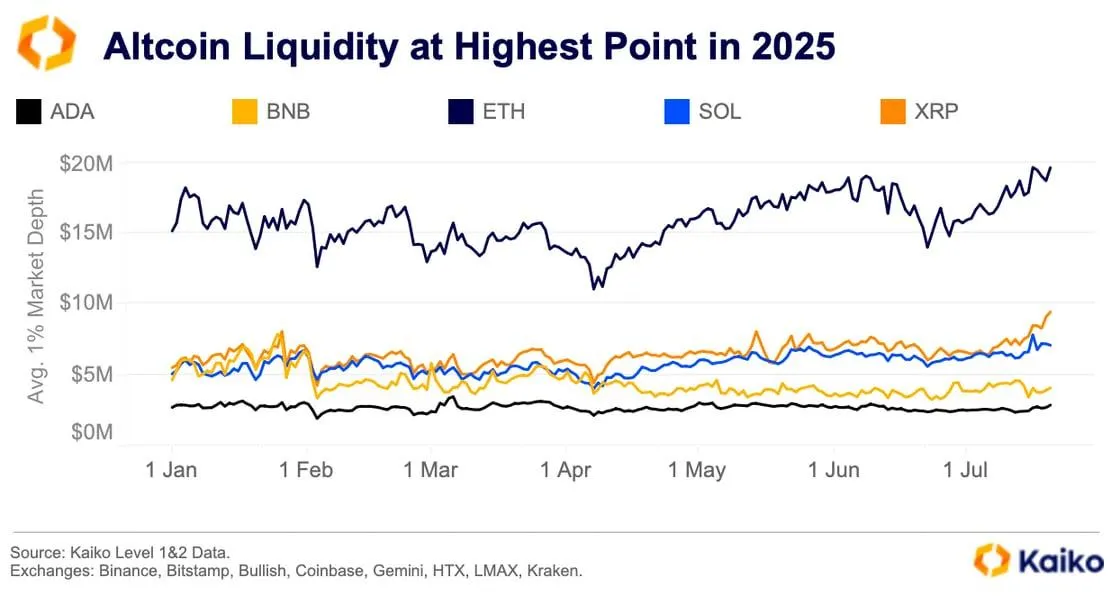

Despite increased liquidity and deep market depth — with XRP recently surpassing SOL, BNB, and ADA — the decreasing number of new investors and sharp price movements pose significant risks for both Long and Short traders.

XRP Exchange Liquidation Map. Source: Coinglass

XRP Exchange Liquidation Map. Source: Coinglass

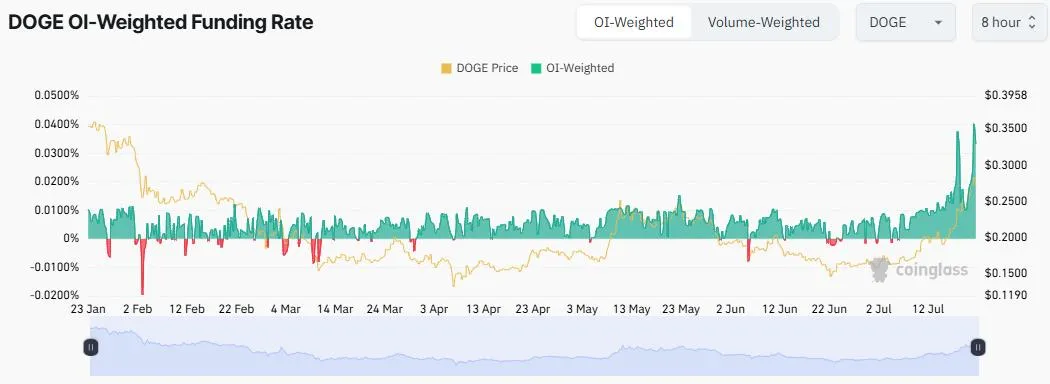

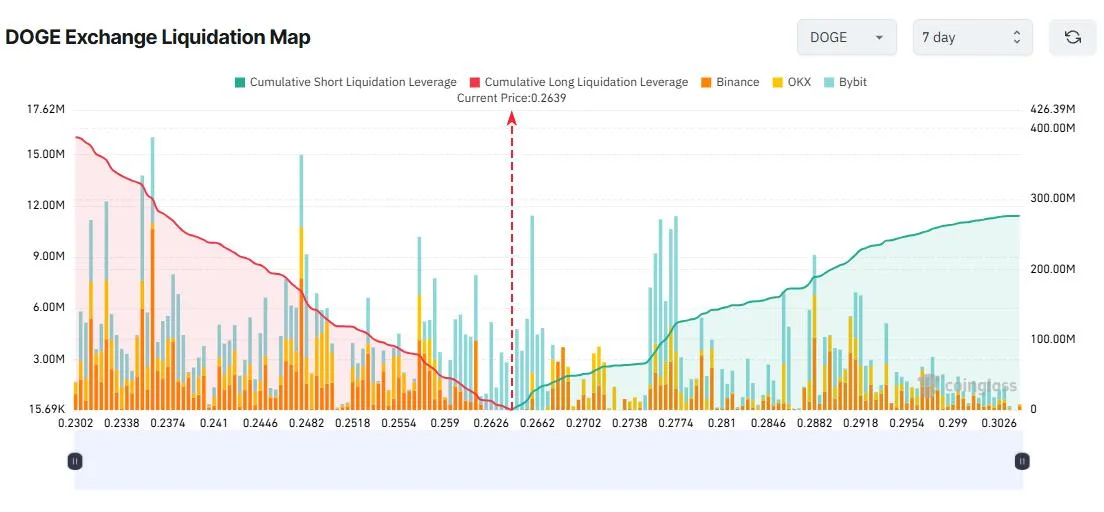

2. Dogecoin (DOGE) – Up To $300 Million In Long Liquidation Risk

DOGE has seen renewed investor enthusiasm in July, especially after Bit Origin announced plans to raise $500 million to establish a Dogecoin Treasury. On July 21, DOGE’s Funding Rate hit its highest level of the year when the price touched $0.28.

However, heavy leveraged Long positions have increased the risk of liquidation. According to Coinglass, if DOGE falls to $0.236, the accumulated liquidation of Long positions could reach $300 million.

Adding to the concern, on-chain data from Lookonchain shows that prominent trader James Wynn recently closed part of his Long position, selling 4.45 million DOGE (worth $1.15 million), possibly signaling profit-taking.

DOGE Funding Rate: Coinglass

DOGE Exchange Liquidation Map. Source: Coinglass

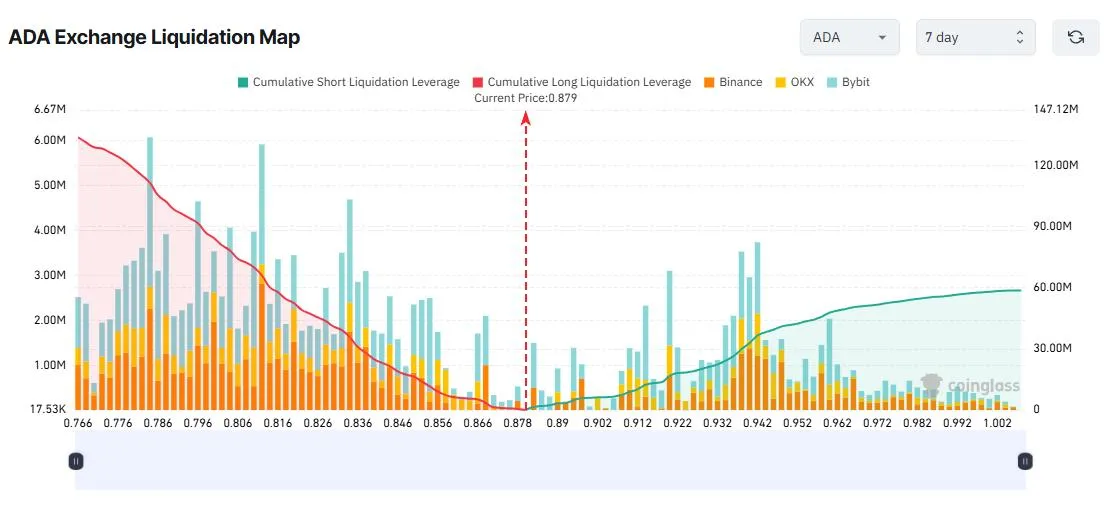

3. Cardano (ADA) – Bullish Potential And Downside Risks Alike

ADA hit a new Open Interest record of $1.74 billion in July, riding a five-week winning streak. On-chain indicators like Coin Age and MVRV Ratio suggest ADA could soon hit $1, triggering Short liquidations worth up to $58 million.

However, downside risks remain. If ADA drops to $0.78, Long position liquidations may exceed $120 million.

Another factor to watch: Cardano co-founder Charles Hoskinson is expected to release an audit report, which could significantly affect trader sentiment.

ADA Exchange Liquidation Map. Source: Coinglass

4. Market Overview: Liquidation Pressure Builds

Total Open Interest across the crypto derivatives market has now surpassed $213 billion, an all-time high. In the past 24 hours alone, over 152,000 traders have been liquidated, totaling $553 million, with more than $370 million coming from Long positions.

With leveraged positions piling up, the risk of large-scale liquidations is becoming a growing concern for altcoin markets heading into the final week of July.