Why Hard Cap and Soft Cap Matter in Crypto Fundraising

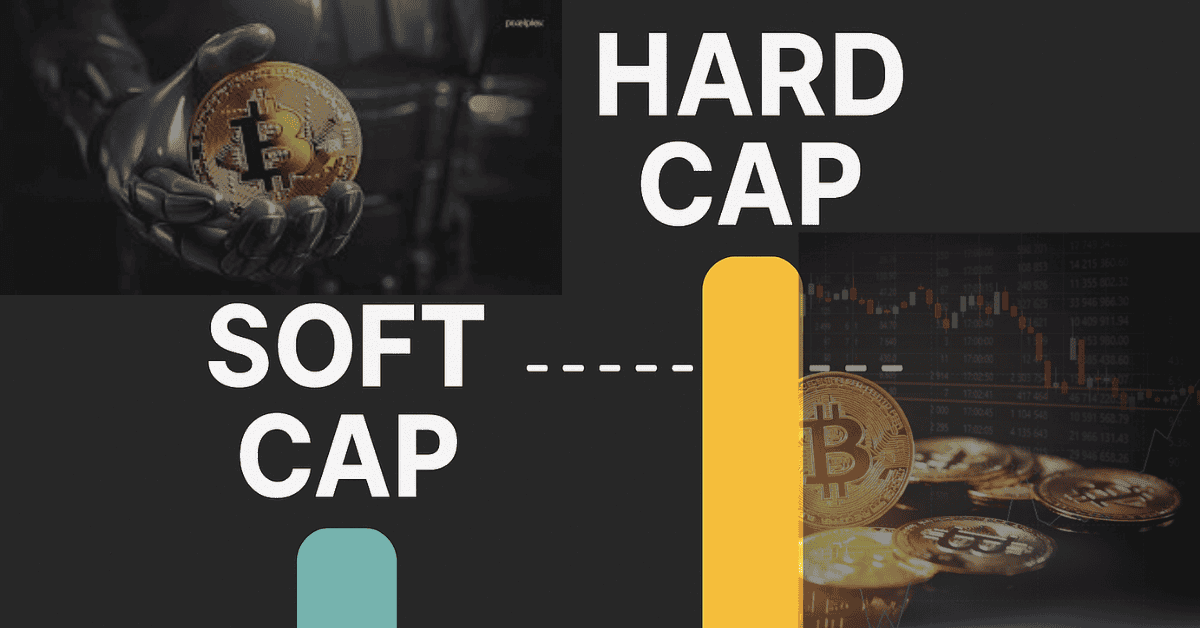

1. What Is Soft Cap?

Soft Cap refers to the minimum funding needed in an ICO for the project to move forward as planned. If this threshold isn’t met, funds may be refunded or the project may proceed with a limited budget.

2. What Is Hard Cap?

Hard Cap is the maximum amount a project can raise during its ICO. When this limit is reached, the fundraising closes. It helps prevent overfunding, inefficient spending, and token dilution.

3. Why Soft Cap and Hard Cap Matter

- Soft Cap ensures the project has enough resources to execute its roadmap and builds investor confidence.

- Hard Cap prevents excessive fundraising, protects token value from dilution, and ensures capital is spent responsibly.

4. Capped ICO vs Uncapped ICO

- Capped ICO sets both Soft Cap and Hard Cap.

- Uncapped ICO accepts unlimited capital, which can allow flexibility but also introduces risks like uncontrolled fund inflow and token devaluation.

5. Real‑World Examples

- Brave set a Hard Cap of $35 million in 2017 and paused fundraising once reached.

- Tezos, on the other hand, raised $232 million over 13 days in 2017 during an uncapped ICO.

6. Pros and Cons

- Capped ICO: Protects investors and project finances from overfunding.

But if caps are too low, the project may need additional funding.

- Uncapped ICO: Allows raising large amounts, but increases risk of token inflation and mismanagement