What is a Straddle? Understanding the Straddle Strategy in Crypto Trading

1. Introduction To Straddle

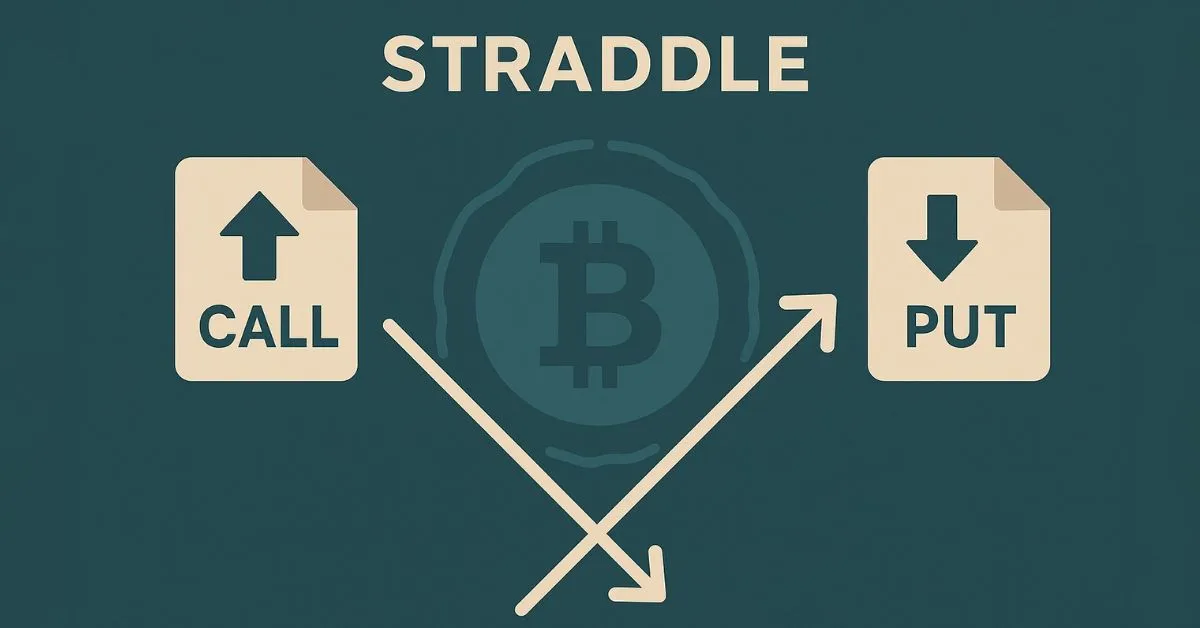

A Straddle is a popular derivative investment strategy used in both traditional and crypto markets. It involves simultaneously buying or selling both a call option and a put option for the same asset, with the same strike price and expiration date. The Straddle strategy is employed to profit from significant price movements of the asset, regardless of the direction.

2. How Straddle Works In Crypto Trading

In a Straddle strategy, an investor simultaneously engages in a call option and a put option for the same asset, with identical strike prices and expiration dates.

• Call Option: Grants the right to buy the asset at a specific strike price.

• Put Option: Grants the right to sell the asset at a specific strike price.

There are two main types of Straddle strategies:

• Long Straddle: Purchasing both call and put options.

• Short Straddle: Selling both call and put options.

3. Long Straddle - Buying Options Strategy

A Long Straddle involves purchasing both a call and a put option for the same asset, with the same strike price and expiration date. This strategy is suitable when an investor anticipates significant price volatility but is uncertain about the direction.

Characteristics:

• Unlimited profit potential if the price moves significantly.

• Risk is limited to the total premium paid for the options.

Example:

Assume Bitcoin is trading at $30,000. You purchase a call and a put option, both with a strike price of $30,000 and expiring in one month. Each option costs $1,000, totaling $2,000.

If Bitcoin rises to $35,000: The call option is worth $5,000, the put option expires worthless. Net profit: $5,000 - $2,000 = $3,000.

If Bitcoin falls to $25,000: The put option is worth $5,000, the call option expires worthless. Net profit: $5,000 - $2,000 = $3,000.

If Bitcoin remains around $30,000: Both options expire worthless, resulting in a $2,000 loss.

4. Short Straddle - Selling Options Strategy

A Short Straddle involves selling both a call and a put option for the same asset, with the same strike price and