Bull Trap in Crypto: How to Avoid It

1. What is Bull Trap?

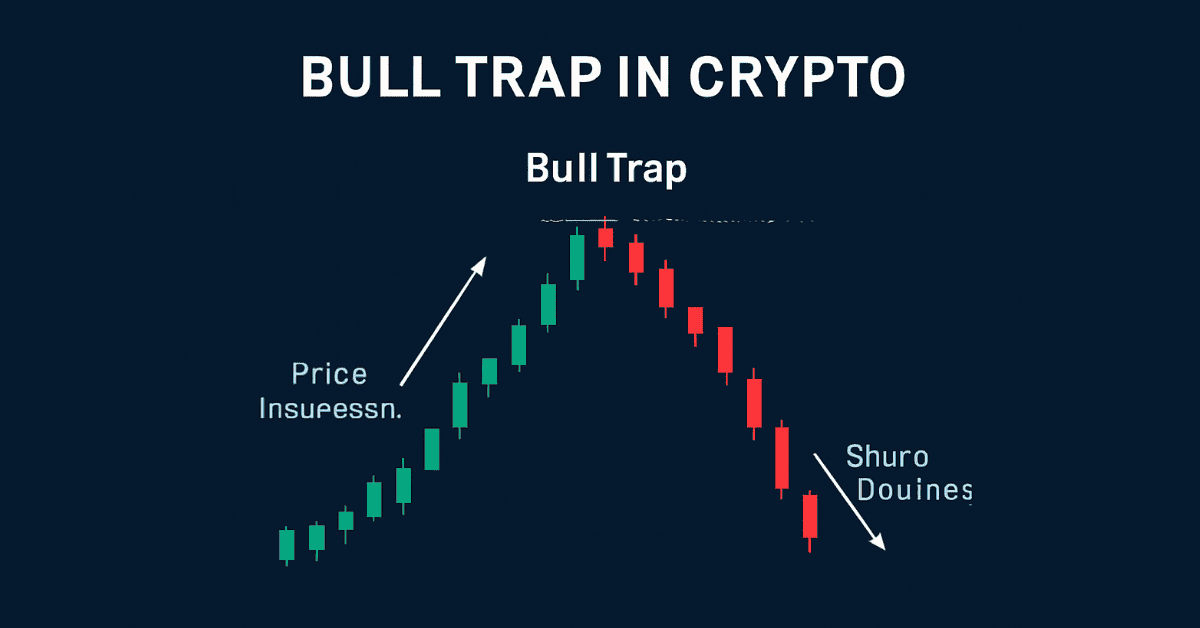

A Bull Trap occurs when the price of an asset seems to reverse from a downtrend to an uptrend, but it's only a temporary recovery. Investors might believe the downtrend has ended and that a new uptrend is starting. They buy the asset expecting profits, but the price reverses and drops again, trapping them in a loss. Bull traps are especially common and risky in the volatile crypto market.

2. Related Terms to Bull Trap

Bear Market: A prolonged period of price decline.

Bull Market: A period of continuous price increase.

Support and Resistance: Levels where the price tends to find support or face resistance.

False Breakout: When the price breaks through resistance but quickly reverses.

Volume: A measure of the total trading activity.

3. Causes and Signs of Bull Trap

FOMO Psychology: Investors fear missing out and rush to buy when prices rise.

Whale Manipulation: Large investors create false price surges by buying large quantities, then sell to profit, leading to a price drop.

Inaccurate News: Fake or unclear news can trigger a temporary price spike, leading to a bull trap.

4. How to Avoid Bull Trap in Crypto Markets

Acquire Knowledge and Technical Analysis Skills: Understanding how to read charts, indicators, and trading volume helps avoid unsustainable price surges.

Observe Crowd Psychology: Avoid getting swept up in a price surge without thorough analysis.

Use Stop Loss and Take Profit Orders: Setting these orders helps manage risk and protects profits.

Be Patient and Wait for Confirmation: Don't rush into buying; wait for market signals.

Monitor Whale Activities: Watch large transactions to detect potential market manipulation.

5. What to Do if Caught in a Bull Trap?

Stay Calm and Assess the Situation: Don’t panic when you realize you’ve bought at a peak.

Cut Losses or Accept Small Losses: Protect the remaining capital by cutting losses if necessary.

Learn from Mistakes: Analyze why the trap occurred and improve your market analysis skills.

Create a Plan for Next Time: Set clear goals and be more patient with your investment decisions.