Asset Tokenization: A Crucial Trend in DeFi

1. What is Asset Tokenization?

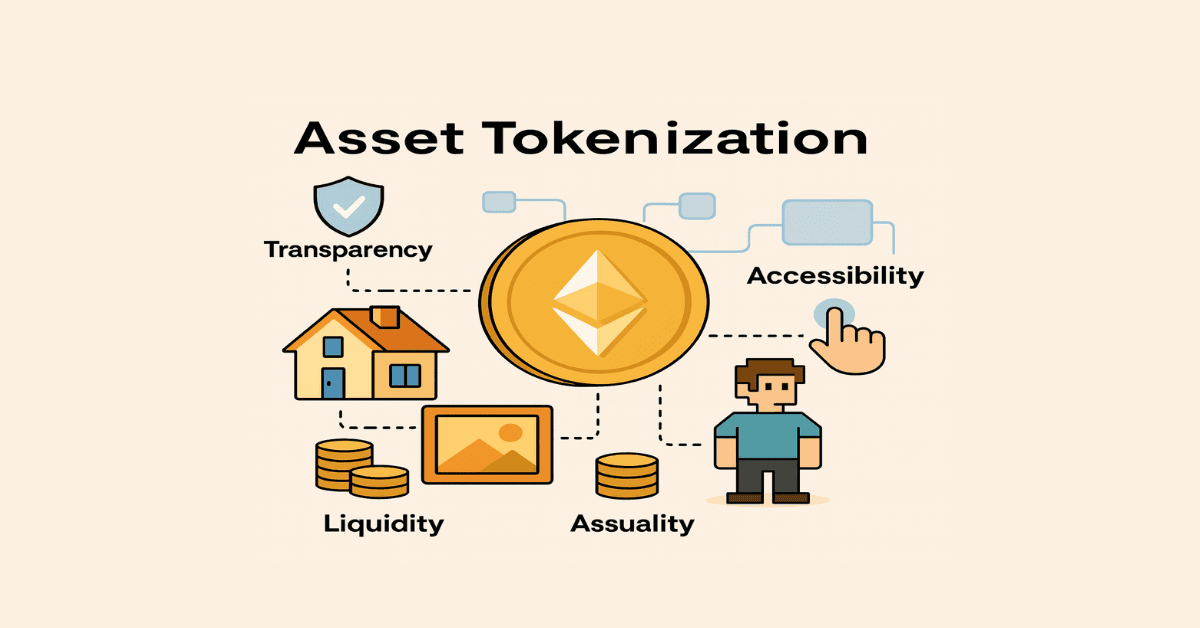

Asset tokenization is the process of converting ownership rights of physical or digital assets into digital tokens stored on a blockchain. Each token represents a portion or the entirety of the asset’s value, enabling transparent, secure, and efficient transactions, management, and ownership.

1.1. Benefits of Asset Tokenization

-

Increased Liquidity: Large, illiquid assets like real estate or art can be fractionalized and traded easily.

-

Transparency & Security: All transactions and ownership records are publicly stored on blockchain.

-

Accessibility: Anyone can invest in high-value assets with small capital via tokens.

-

Cost Efficiency: Reduces reliance on intermediaries, lowering transaction and management costs.

1.2. Real-World Examples

-

Real Estate: A commercial building in New York was fractionalized and sold via blockchain tokens.

-

Artworks: Beeple’s NFT “Everydays: The First 5000 Days” sold for tens of millions of USD.

-

Digital Assets: In games like The Sandbox and Decentraland, virtual land and items are tokenized to form digital economies.

2. Types of Tokenizable Assets

2.1. Real-World Asset Tokenization (RWA)

Includes real estate, gold, commodities, stocks, bonds, carbon credits, IP, and more. The goal is to bring off-chain assets on-chain for better liquidity, transparency, and use as collateral.

Example protocol: Ondo Finance.

2.2. Digital Asset Tokenization

Assets already existing in digital form on blockchain, such as:

-

DAO Governance Tokens (e.g., MKR, UNI): Represent voting rights in decentralized governance.

-

Cross-chain Assets: Like Wrapped BTC (WBTC), a tokenized version of Bitcoin on Ethereum.

-

DeFi Yield Tokens: aTokens from Aave represent lending positions and interest accrual.

2.3. In-Game Asset Tokenization

GameFi and metaverse assets are tokenized to enhance usability and tradeability:

-

NFTs in Games: Weapons, characters, skins...

-

Game Tokens: In-game currencies for purchases and upgrades.

3. Asset Tokenization Process

3.1. Identify and Value the Asset

Determine the asset’s legality, ownership, and valuation before tokenization.

3.2. Fractionalize the Asset into Tokens

-

Fungible Tokens (FT): Identical tokens representing equal asset shares (e.g., company shares).

-

Non-Fungible Tokens (NFT): Unique tokens for distinct parts (e.g., apartment unit 5B).

3.3. Create Tokens on Blockchain

Using smart contracts to encode ownership data, values, and transaction conditions.

3.4. Token Distribution

-

Direct sales to investors.

-

Listing and trading on DEXs or CEXs.

3.5. Asset Management and Trading

Tokens can be transferred, traded, or used as collateral. All activity is transparently logged on blockchain.

3.6. Token Holder Rights

-

Financial Returns: e.g., rental income from real estate.

-

Governance Participation: if token represents equity.

-

Utility or Collectibility: especially in digital or gaming assets.

Example: A $1 million building split into 1,000 tokens → Each token represents 0.1% ownership.

4. Current Status and Future Trends

Leading financial institutions are actively researching and implementing blockchain-based tokenization to enhance services, reduce costs, and expand global investment opportunities with greater transparency.