Analysis of Break-Even Point (BEP) in Crypto

Thanh Tú•6/26/2025

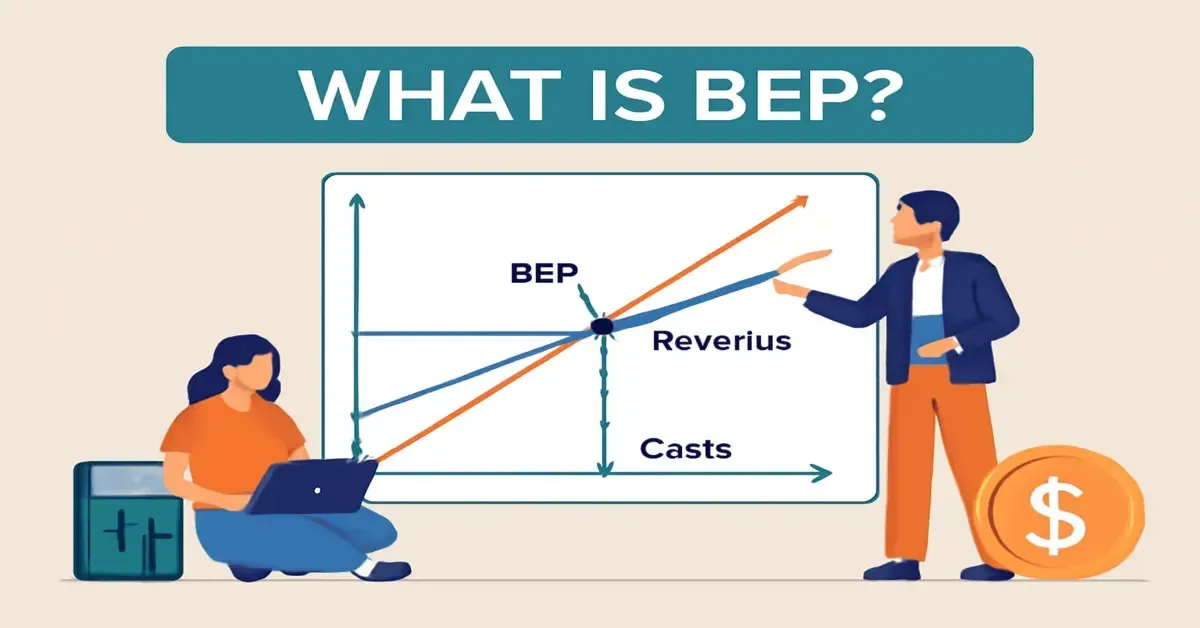

1. What is Break-Even Point?

Definition and Significance of Break-Even Point

Break-Even Point (BEP) is the price or time when total investment costs equal total revenue or asset value, meaning you neither make a profit nor incur a loss. In the crypto market, BEP helps investors determine the price required to recover their investment after accounting for costs such as the purchase price, transaction fees, and other related costs.

2. The Formula for Calculating BEP in Crypto

2.1. Basic Formula

The basic formula for calculating BEP is:

BEP = (Total Investment Costs + Transaction Fees) / Number of Tokens Owned

2.2. Example Illustration

Example: You buy 1 ETH at $1,500 and pay a transaction fee of $50. In this case, your BEP would be:

BEP = (1,500 + 50) / 1 = 1,550 USD

If the price of ETH rises above $1,550, you start making a profit. Conversely, if the price is lower, you incur a loss.

3. Factors Affecting BEP

3.1. Purchase Price of Token

The higher the purchase price, the higher the BEP. If you buy a token at a high price, you will need the market price to rise higher to reach the break-even point.

3.2. Transaction Fees

Transaction fees include:

Exchange transaction fees: Typically ranging from 0.1% to 0.3% per transaction.

Gas fees on the blockchain: For example, on Ethereum, gas fees can be very high during periods of congestion (ranging from $20 to $200 per transaction).

High fees will increase BEP, so users should choose the right time and blockchain to minimize costs.

3.3. Market Volatility

The crypto market is known for its high volatility:

Rapid Price Increase: When the market rises quickly, BEP is easier to reach.

Deep Price Decline: If the token price drops significantly, BEP becomes harder to reach and may lead to a loss.

Investing in tokens with high intrinsic value and low volatility can help reduce risks.

3.4. Token Holding Period

The holding period of a token affects BEP through additional earnings from mechanisms such as staking or farming:

Staking: Earning rewards from staking tokens can lower BEP.

Farming: Earnings from liquidity farming can also help reduce BEP, but you need to consider the risk of "impermanent loss."

4. BEP Applications in Specific Scenarios

4.1. Buying and Selling Crypto Assets

Scenario: An investor buys 10 ETH at $1,800 per ETH, and the exchange fee is 0.5%.

Total purchase cost: 10 × $1,800 = $18,000.

Transaction fees: (1,800 × 0.5%) × 10 = $90.

Total cost: $18,000 + $90 = $18,090.

To break even, the selling price of 10 ETH needs to reach a total value of $18,090, which means the price of ETH must exceed $1,809 per ETH.

4.2. Staking and Yield Farming

An investor stakes 100 token A at $2 per token, with a total investment of $200. The project provides a 20% APY staking reward.

Staking profit after 1 year: $200 × 20% = $40.

Total value after 1 year: $200 + $40 = $240.

BEP will decrease because the staking rewards help offset the initial investment.

4.3. Mining (Coin Mining)

For coin mining activities, BEP is calculated based on hardware costs, energy consumption, and other operational costs. If the total value of mined coins equals these costs, you reach the break-even point.

5. Conclusion

Understanding and accurately calculating Break-Even Point (BEP) helps crypto investors make informed decisions, manage risks effectively, and optimize profits. Regularly tracking BEP, especially in a volatile market like crypto, is an essential part of a successful investment strategy.