5 Ways To Minimize Price Impact In Crypto

1. What Is Price Impact?

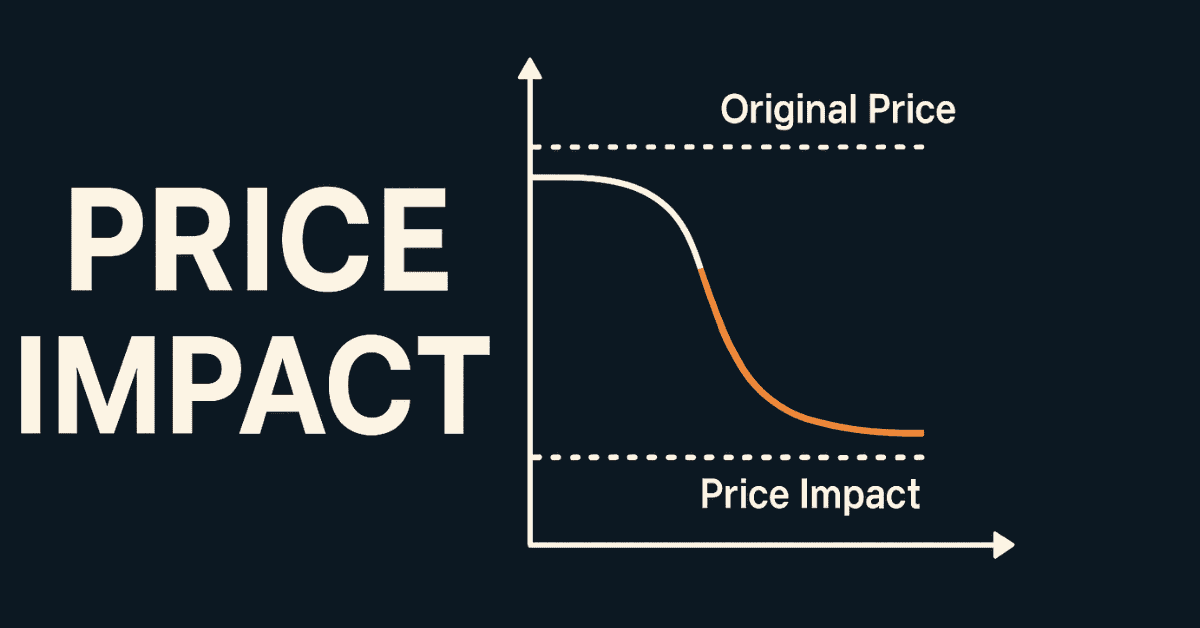

Price Impact describes how much a trade order affects the asset’s market price. Large buy or sell orders can shift prices up or down relative to the current market .

2. Difference Price Impact From Slippage

-

Price Impact results from your own trade changing market liquidity.

-

Slippage is the gap between the expected and actual execution price, often due to broader volatility or execution delay .

3. Influencing Factors

-

Liquidity: Higher liquidity reduces price impact. Low liquidity means higher impact.

-

Order Size: Bigger trades have a greater effect.

-

Market Volatility: Highly volatile markets amplify price shifts .

4. How To Mitigate It

-

Split large trades into smaller ones.

-

Use exchanges or pools with high liquidity.

-

Place limit orders rather than market orders.

-

Monitor order book depth to understand available liquidity.

-

Use aggregators (e.g., 1inch, Paraswap) to optimize routes and minimize impact .

5. Summary

Grasping price impact and taking steps to reduce it helps improve trade outcomes, especially for assets with limited liquidity.