Understanding MEV in Layer 2 Rollups

Introduction

As Ethereum scales, Layer 2 solutions like rollups have emerged as essential tools to reduce congestion and lower fees. Rollup Economics is the study of how value and incentives are distributed in these systems. In this guide, we examine the economic structures of two leading optimistic rollups: Optimism and Arbitrum One.

1. Key Components in a Rollup System

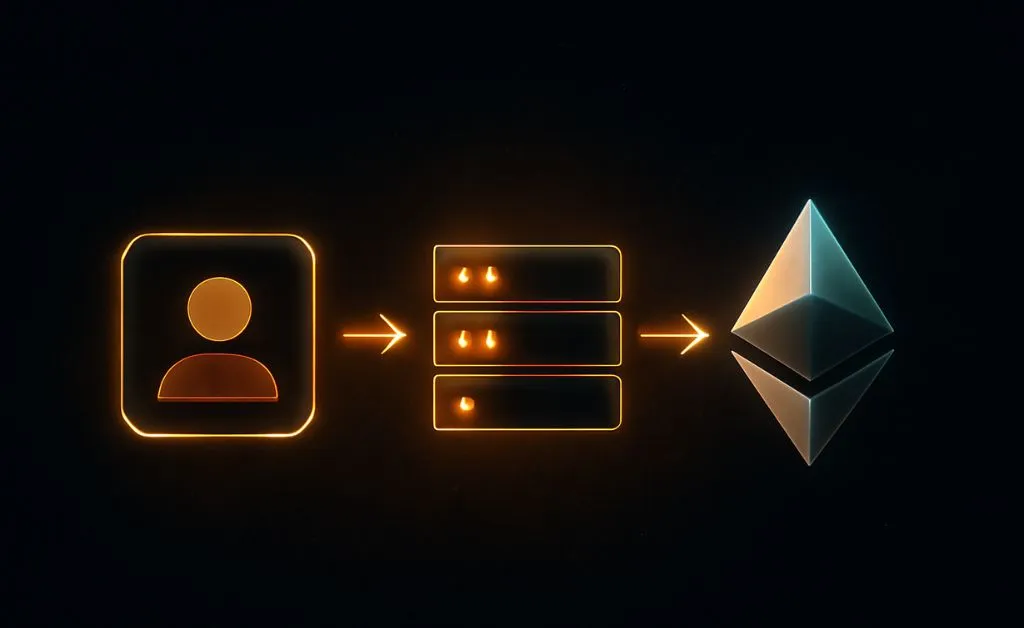

Each rollup system is built around three roles:

Users, who send transactions through wallets like MetaMask.

Rollup operators, who batch transactions and post them to Ethereum.

Ethereum L1, which serves as the verifier and data availability layer.

2. Transaction Fees and Value Flow

Every transaction carries a fee, which consists of:

Data submission cost to Ethereum, for publishing transaction data and state root.

Operator profit margin, which is the remainder after L1 data costs.

For instance, if a user pays $0.30 per transaction, around $0.20 might cover the Ethereum data cost, and $0.10 becomes the rollup’s profit. This flow ensures that operators have an incentive to efficiently batch transactions while keeping fees affordable for users.

3. MEV – Maximal Extractable Value

MEV refers to profits gained by reordering transactions strategically. On rollups, MEV can be captured by bots performing arbitrage between DEXs or other forms of on-chain trading.

Both Optimism and Arbitrum can extract MEV value through their transaction sequencing mechanisms. If integrated deeply, MEV becomes a long-term value capture strategy, especially as transaction volumes increase.

4. Comparing Optimism and Arbitrum

While both are Optimistic Rollups, they take different technical and economic approaches. Optimism emphasizes simplicity and ecosystem scalability through OP Stack, making it easy to deploy similar rollups. In contrast, Arbitrum focuses on performance and efficiency, using multi-round fraud proofs to resolve disputes and compressing data to lower transaction costs.

Their data strategies also differ—Optimism tends to publish more data on-chain for trust, while Arbitrum aims for minimal cost via compression. These design decisions influence fee structures and how MEV profits are distributed.

Conclusion

Rollup Economics is more than fee optimization—it is about fair and sustainable value sharing among users, operators, and Ethereum itself. Whether through Optimism’s unified approach or Arbitrum’s performance-driven model, Layer 2 solutions are pushing Ethereum closer to mass adoption by making transactions faster and more affordable.