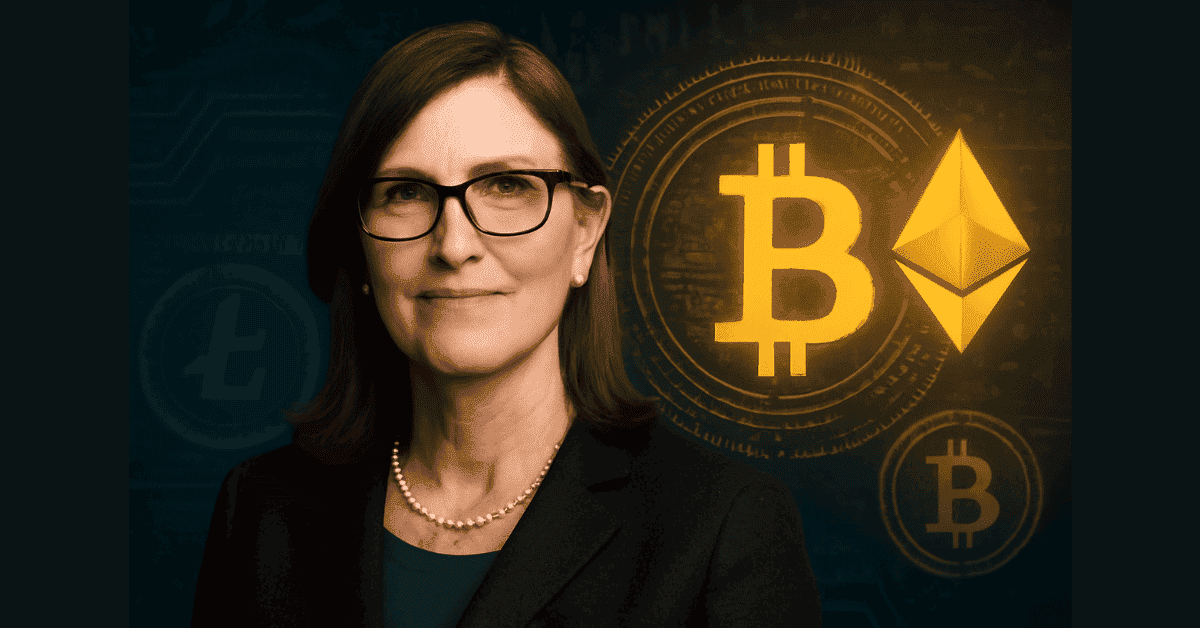

Cathie Wood: Bold Crypto Investor Shaping Wall Street

In the dazzling world of finance on Wall Street, Cathie Wood stands out as a unique symbol – someone who dares to go against the crowd to seek out "hidden gems" in technology with the potential to shape the future.

Cathie Wood is not a conventional investor. She doesn’t profit from analyzing financial reports or applying traditional investment principles.

Instead, Cathie is willing to bet her entire career on companies that many experts consider risky, even "bubbles." Names like Tesla, Bitcoin, AI, and gene editing technology – all of which many call "delusions" – but Cathie has no hesitation in investing in them.

For some, she is a prophet of the new tech era, while for others, she is a reckless dreamer, gradually destroying her reputation with uncertain forecasts. However, before making any judgment, it is essential to understand the factors that have shaped Cathie Wood into the unique figure she is today.

1. From an Ordinary Girl to a Tech Pioneer Icon

Born in 1955 in Los Angeles, Cathie Wood came from a family of Irish immigrants. Her father, a military engineer who designed radar systems and guidance systems for the U.S. Air Force, instilled in Cathie a passion for technology and analytical thinking from a young age.

For Cathie, technology is not just a tool for making money; it is the key to unlocking the future. From high school, she spent a lot of time studying military science documents and could easily explain the workings of missiles to her friends.

While studying economics and finance at the University of Southern California (USC), she met the most influential mentor of her career: Professor Arthur Laffer, the founder of the famous Laffer Curve theory (a theory about the relationship between tax rates and tax revenue). From this, Cathie learned that all economic and technological trends operate in cycles. Those who recognize these cycles early will win.

With this philosophy, Cathie began to form her unique investment approach: invest in breakthrough technologies that the world has yet to recognize their potential, so that when they become mainstream, she would reap great rewards. After graduating from USC, Cathie began her career at Capital Group, then spent nearly 20 years at Jennison Associates – two well-known investment management firms in the U.S.

However, it was at AllianceBernstein, where she served as Chief Investment Officer, that Cathie realized her philosophy was vastly different from traditional investment funds. When she proposed investing in companies with world-changing technologies but no profits, the leadership at AllianceBernstein dismissed her as a dreamer who didn't understand reality. This decision led Cathie to leave AllianceBernstein in 2014 and found ARK Invest, where she could fully pursue her vision without being constrained by old models.

2. Peak Success Always Comes with Deep Valleys

From the beginning, ARK Invest, under Cathie Wood’s leadership, stood out with an entirely different investment strategy. The company focuses only on businesses with disruptive technologies and always publicly discloses its investment portfolio. Cathie believes that investing should not be a secret profit-making scheme but an open dialogue with the community to shape the future.

ARK Invest primarily invests in five key areas, which Cathie calls the "convergence of technologies," including artificial intelligence (AI), blockchain, biotechnology, electric vehicles, and renewable energy. One of the most prominent investments was Tesla. When ARK began buying Tesla shares in 2016 at under $40 per share, most Wall Street experts considered it a risky decision. At that time, Tesla was burdened with massive debt and on the brink of bankruptcy, criticized as a company that thrived only on Elon Musk’s storytelling.

However, Cathie Wood didn’t see Tesla as just a car company. She viewed Tesla as a data company, an AI company, and a pioneer in clean energy. By 2021, Tesla’s market value soared to $1.2 trillion, bringing ARK a profit of over 1,500%. Cathie Wood became a star, known as the "queen" of Wall Street.

When the COVID-19 pandemic struck in 2020, ARK received a significant boost. As people shifted to working online, tech stocks surged, leading to ARK Innovation ETF (ARKK), Cathie's flagship ETF, experiencing massive growth. ARKK gained 153% in 2020, and ARK's assets skyrocketed from over $3 billion to $60 billion. Cathie Wood quickly became the new investment icon for the younger generation, hailed as the Warren Buffett of the technology era.

However, her overconfidence in optimistic forecasts put Cathie Wood in a difficult position. In 2022, when the Federal Reserve changed its monetary policy and raised interest rates to control inflation, money began flowing out of tech stocks. ARKK lost 67% of its value in a year, becoming one of the worst collapses in ETF history. Instead of defending, Cathie continued buying stocks as prices dropped, especially investing in Roku, Zoom, and Coinbase. Many analysts thought she was "catching a falling knife," believing that these stocks would soon recover.

A performance comparison between ARKK and NASDAQ from 2015 to 2025 clearly shows the ups and downs of ARK's journey. ARKK had once surged thanks to disruptive technologies during the pandemic, but later dropped significantly when the market reversed. Although there was a slight recovery, the glory is still distant.

Morningstar, a leading financial analysis company, ranked ARKK among the funds with the biggest losses in the past decade, with total losses of up to $7.1 billion (as of December 31, 2023). Cathie Wood’s story quickly became a valuable lesson for investors: nothing grows forever, and overconfidence in forecasts can come at a very high price.

3. The "Challenge the Majority" Philosophy and Belief in Long-Term Future

Despite criticism from many sides, Cathie Wood has not changed her investment philosophy. She continues to make bold predictions about advanced technologies: Tesla will reach $2,000 per share by 2027, and Bitcoin could hit $1.5 million by 2030 due to increased adoption by major financial institutions and institutional investors.

While these numbers have caused many in Wall Street to laugh, Cathie remains unshaken. What matters to her is not the forecasted figures, but the way she publicly discloses all the models and valuation methods of ARK. From basic assumptions to the smallest details, Cathie is unafraid of criticism; what concerns her most is that people refuse to think big.

What makes Cathie’s philosophy stand out is how she completely opposes Warren Buffett. While Buffett is known for his value investing philosophy, focusing on companies with sustainable competitive advantages and stable revenue, Cathie Wood needs only disruptive technology – even if the company has no profits right away. For her, innovation and the potential of technology are more important than any current financial factors.

While Buffett advocates for capital preservation and risk aversion, Cathie sees risk as a driver of development. She believes that "betting on old giants is riskier than joining startups and creative founders."