Bitcoin Faces Pressure as Tech Rout Hits Crypto Sentiment

1. Tech Rout Weighs On Crypto Sentiment

The latest decline in U.S. technology stocks, particularly AI and data center leaders, has spilled into the cryptocurrency market, dampening Bitcoin’s recovery attempt. With AI companies reporting weaker earnings and higher debt burdens, the Nasdaq posted its sharpest fall since early August, dragging correlated assets lower. Bitcoin slipped 4% from recent levels, showing just how closely tied it remains to global risk sentiment.

Yet institutional flows tell a different story. Data shows Bitcoin spot ETFs posted net inflows of $333 million on Tuesday, led by Fidelity’s FBTC with $133 million. Ethereum ETFs, meanwhile, recorded $135 million in outflows. Corporate treasuries also kept accumulating: MicroStrategy added 4,048 BTC, while SharpLink boosted ETH holdings by 39,008 coins. CEA Industries, ETHZilla, and CleanCore each expanded their crypto treasuries across BNB, ETH restaking, and even DOGE, showing diversification beyond Bitcoin.

2. Market Outlook: Mixed but Resilient

The debate over Bitcoin’s trajectory is polarized. Some analysts foresee stabilization near $107K, while others warn of deeper corrections toward $92K if momentum weakens further. Ethereum, despite a recent 6% weekly drop, has maintained stronger investor enthusiasm, with concerns about staking redemptions largely fading.

Gold’s surge to $2,600/oz (+33% YTD) adds complexity, suggesting investors are hedging broadly across hard assets. The interplay of macro policy signals, including tariff headlines and speculation on larger Fed rate cuts, is increasingly steering crypto’s short-term direction.

3. Technical Indicators Signal Caution

On Binance and Coinbase, cumulative volume delta data indicates that large holders in the 10,000–10 million BTC category have been selling more aggressively than they are buying, while smaller retail cohorts (100–10,000 BTC) continue to accumulate each dip. This divergence highlights the persistent pressure from whales and institutional-sized traders, even as retail participants step in at lower levels.

Liquidation heatmaps show a notable liquidity cluster around $104,000, while significant bid support lies at $105,000, $102,600, and $100,000, with deeper liquidity pockets extending to the $99,000–$92,000 zone. These levels reflect where buyers are likely to defend, but also signal the risk of further downside volatility if those bids fail to absorb sustained selling.

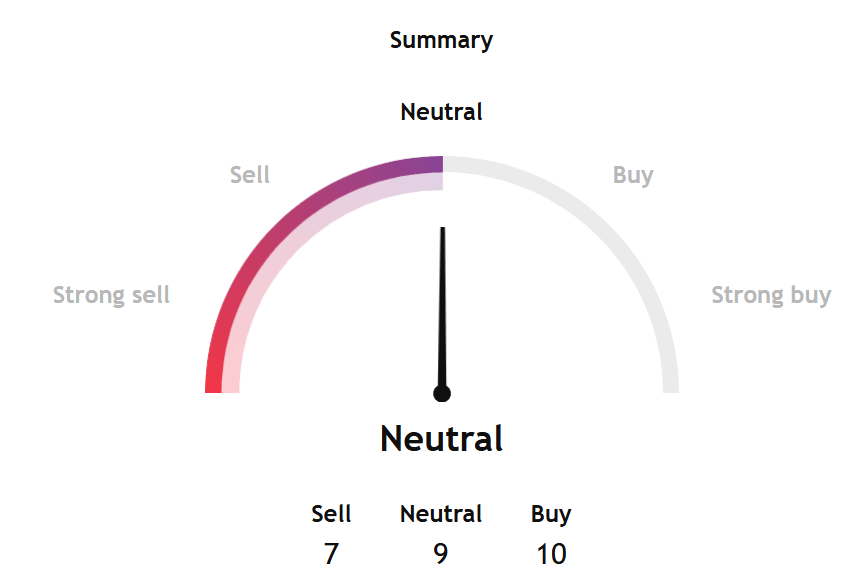

TradingView’s BTCUSD dashboard gave an overall neutral signal this week. However, a deeper look shows sub-indicators such as oscillators and moving averages tilting bearish, aligning with price rejection at key resistance levels.

Source: TradingView

Source: TradingView

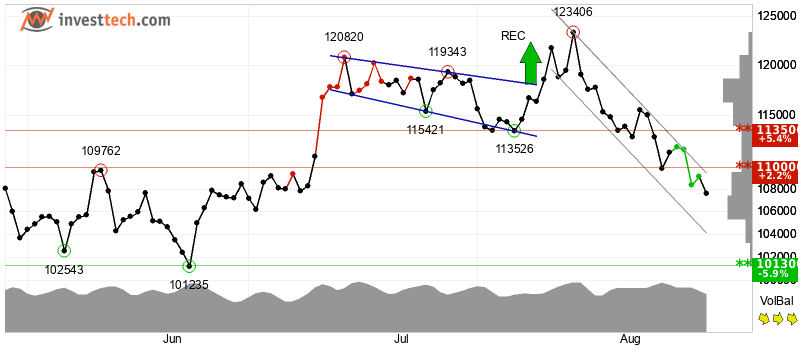

Similarly, InvestTech’s algorithmic analysis offered a weak recommendation for the next one to six weeks, pointing to a descending channel pattern. According to the report, Bitcoin currently faces resistance near $110,000 and support around $101,300, indicating a tightening range with downside bias.

Source: InvestTech

Source: InvestTech

Despite these bearish technical signals, supply dynamics remain relatively constructive. Only about 9% of circulating BTC is currently held at a loss—a shallow figure by historical standards. In addition, the mean coin age over the last three and six months has been gradually increasing, reflecting steady accumulation by long-term holders and suggesting that broad whale distribution has not yet taken place.

4. Balancing Short-Term Weakness With Long-Term Strength

In the near term, downside risks remain elevated as whale selling and futures market pressures continue to weigh on Bitcoin’s ability to stage breakouts. Technicals point to sellers maintaining control, and order book liquidity suggests that further testing of lower levels is possible.

Yet, institutional flows into BTC spot ETFs, corporate treasury strategies adding billions in assets, and the relatively shallow percentage of supply in loss all provide a strong foundation. These factors indicate that while short-term trading signals lean negative, the broader structural environment supports long-term optimism.

For patient investors, this pullback appears more like a manageable correction within the cycle rather than the start of a prolonged breakdown. The balance between technical caution and institutional conviction highlights the dual forces shaping Bitcoin’s outlook: pressure in the short term, but resilience in the bigger picture.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.